Interest Rates and Pensions

With headline inflation remaining stubbornly high at 8.7% and core inflation (which excludes volatile components such as energy and food prices) actually increasing from 6.8% to 7.1%, the Bank of England was left with no choice in June but to raise the Bank Rate once again.

And so, it did, by an unexpected 0.50% (market consensus expected a 0.25% increase, instead), for the 13th consecutive time in a row, raising the Bank Rate to 5%, a level not seen in more than 15 years.

In the United States, the Federal Reserve (the “Fed”) opted instead for a “skip” early in June, leaving the level of interest rates unchanged.

However, the Chairman of the Fed, Jerome Powell, was quite clearly also conveying the message this pause did not indicate the end of the interest rates hiking cycle, the Fed would still be ready to hike rates if necessary.

Market consensus in the US is currently expecting one or two more interest rate hikes by year end, albeit with a high margin of uncertainty.

How Do Interest Rates Affect Pensions?

For savers contributing into Defined Contribution pensions, the effect of rising interest rates on the pension pot depended mostly on the type of assets invested in by the pension scheme.

At a general level, the higher the percentage of fixed interest assets held, particularly government bonds but also corporate debt, the more negatively the pension pot is likely to have been impacted.

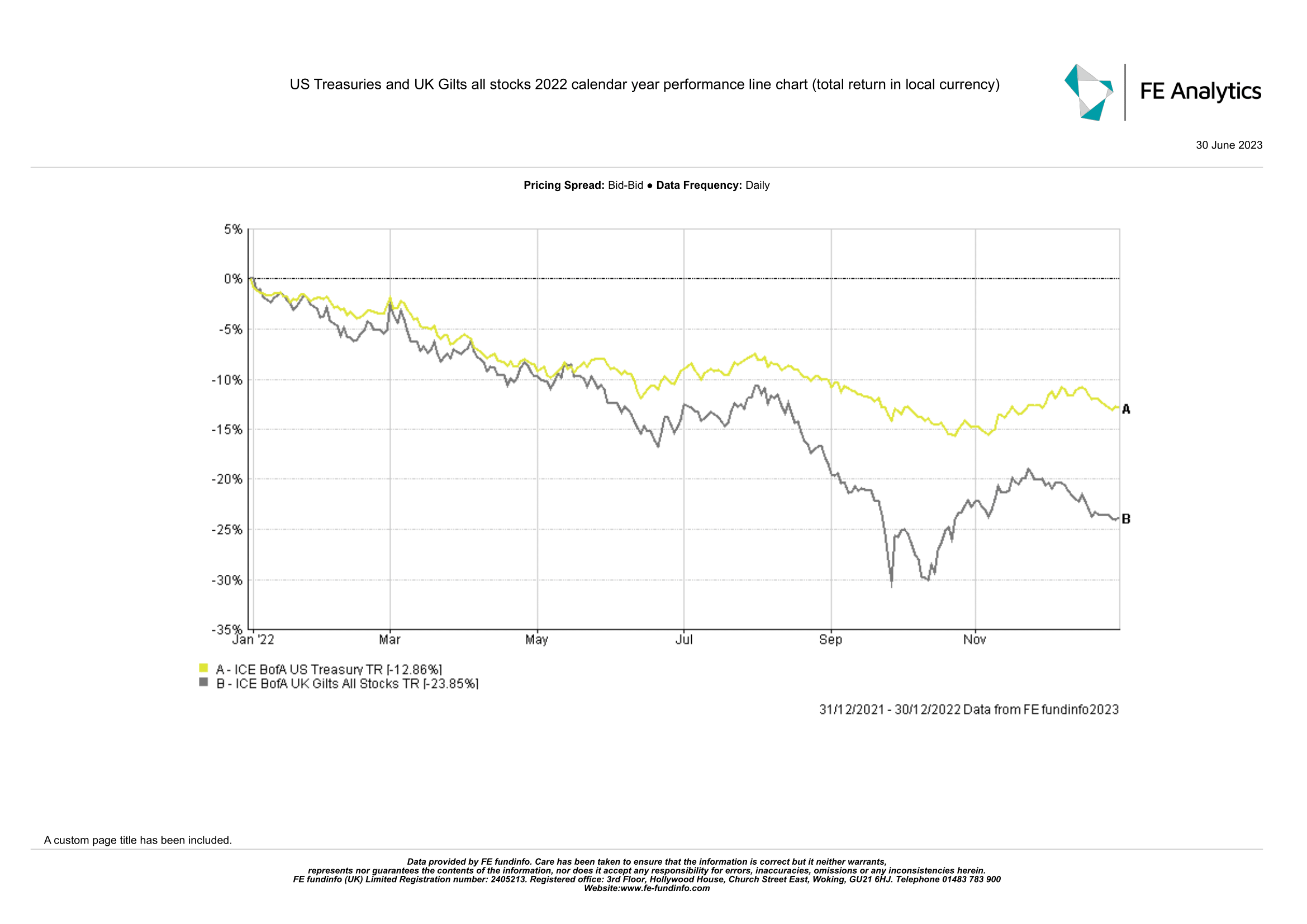

For instance, over the course of calendar year 2022, aggregated indices of US Treasuries and UK Gilts across all maturities returned -12.8% and -23.8% respectively:

Over periods of 10 years, historical correlations suggest a generally positive co-movement between the yield on the US 10-year Treasury note and certain sectors of the economy, particularly cyclical ones, such as energy, financials and industrials, with these sectors on average benefiting from rising interest rates.

By contrast, historical correlations suggest a generally negative co-movement between the yield on the US 10-year Treasury note and other sector such as consumer discretionary, real estate, technology, and communication services, i.e., these sectors tend to underperform with rising interest rates. The reason being the shares of companies operating in these sectors are known in jargon as being “long duration” assets, i.e., very sensitive to rising interest rates.

This is what happened practically all over 2022.

Therefore, the investment performance of Defined Contribution pension pots, at least since December 2021 when the major central banks embarked on a swift interest rate hiking cycle, has been the resultant of the varying mix of these different asset classes.

Another adverse effect of high interest rates concerns pension savers who are looking to transfer their safeguarded benefits in Defined Benefit pensions, and this is because the cash equivalent transfer value is likely to have fallen as a result of rising interest rates.

However, for those looking to purchase an annuity, higher interest rates are generally good news as this could mean they may be able to receive a higher income. Ditto for savers with cash deposits, at least in nominal terms, abstracting from the erosion of purchasing power due to high inflation.

What's Next for Interest Rates and Pensions?

On the expectation inflation at least at the headline level has finally peaked and has started to come down, more steadily in the US, still with a lot of friction and stickiness in the UK, it is likely that no more than one, maybe two interest rates at most are on the horizon by year end.

Even though one does not need to go as far as the Canadian born economist J.K. Galbraith who stated that “the only function of economic forecasting is to make astrology look respectable”, to try and predict where interest rates are going from here is extremely difficult, given the many variables at play.

Therefore, remaining diversified in terms of geography and asset classes, as well as aligning investment portfolios to the individual attitude to risk and capacity for loss, seems to be the most sensible course of action investors can take in the current circumstances.

Expert Financial advisers in Birmingham, London and Warwick

Here at KLO, we focus on providing our clients with expert financial advice across a variety of areas. From personal financial advisers to independent pension advice from a local pension adviser.

So, if you are looking for dedicated financial services in Birmingham, London, Warwick, or surrounding areas then speak to our experts today. Call us on 01926 492406.

Disclaimer

Any research is for information purposes only and does not constitute financial advice. The value of investments and any income from them may go down as well as up, so you may get back less than you invested. Past performance cannot be relied upon as a guide to future performance. KLO Financial Services Ltd are registered in the UK, company number 08711328. We are authorised and regulated by the Financial Conduct Authority, reference 710272. For any information please visit our website www.klofinancialservices.com