Prospects Brighten for Small and Medium-Sized Firms

Stock market performance exceeding expectations

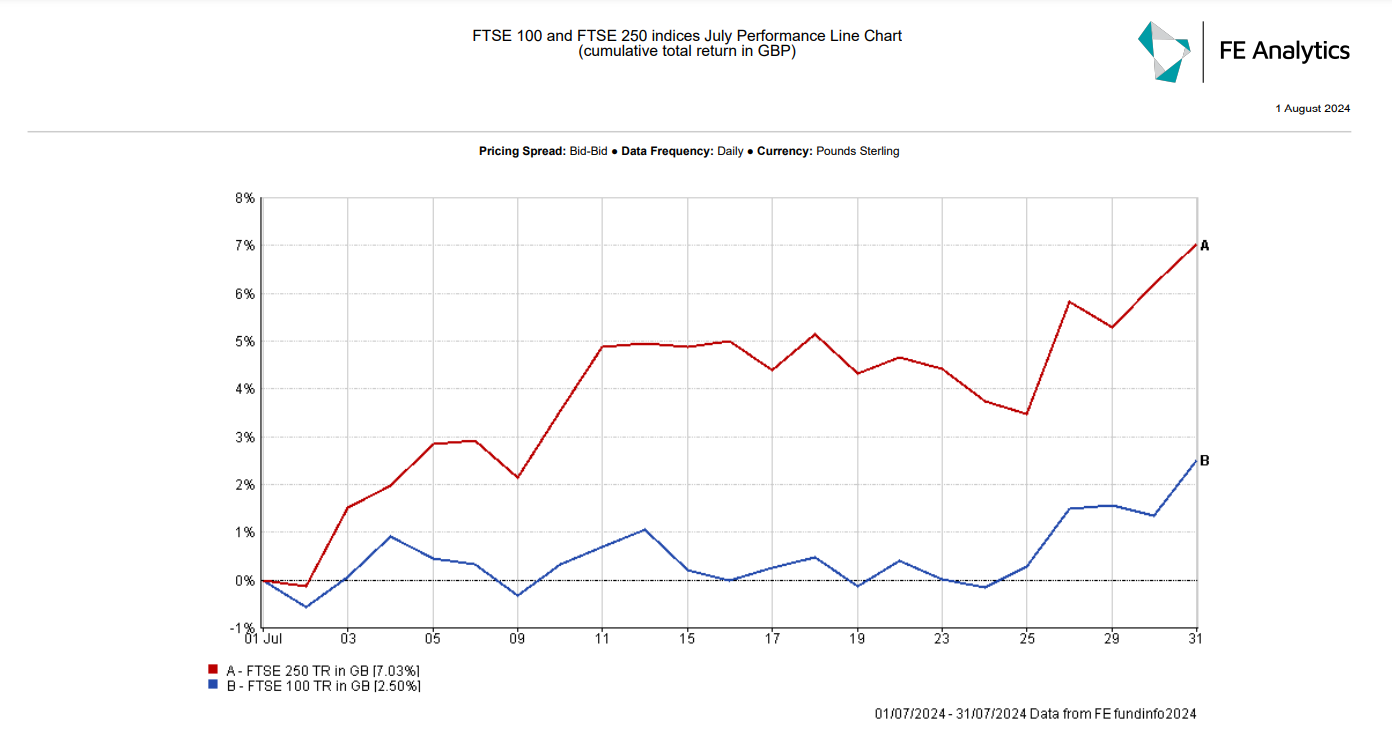

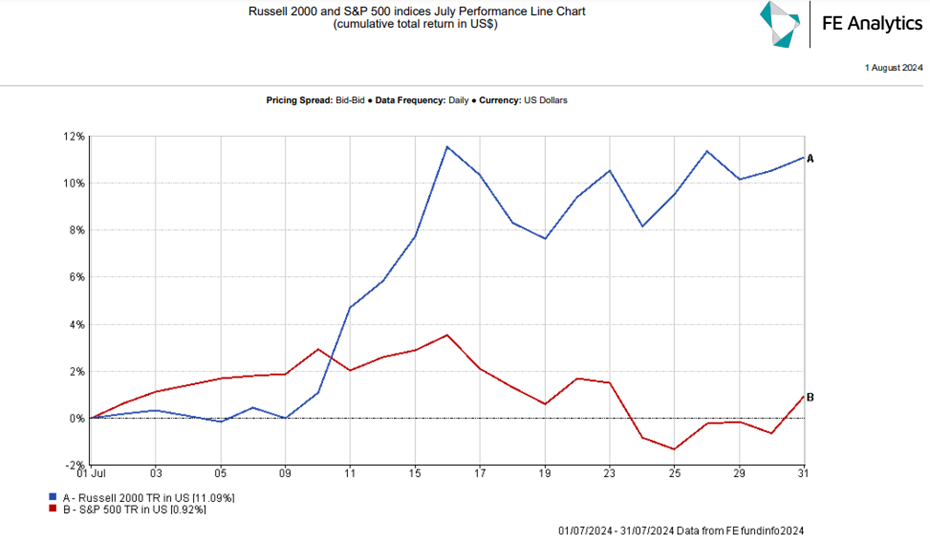

The month of July witnessed a rotation of investors’ sentiment towards favouring small and medium sized companies and away from large cap companies, as proxied by the performance of the FTSE 250 index vs. the FTSE 100 index in the UK and as demonstrated by the returns gained by the Russell 2000 index vs. the S&P 500 index in the US:

What caused this effect on the stock market?

The UK economy rebounding from a shallow technical recession at the end of 2023, stabilising inflation now back to the mandated 2% target and the Bank of England starting to cut interest rates are all tailwinds for small and medium sized companies. They generally carry proportionally more debt on their books compared to big companies, hence falling interest rates and an expanding economy are expected to boost their profit margins.

Similarly in the US, the economy remains stable, inflation is gradually but steadily abating, and the US Federal Reserve (the “Fed”) is expected to start reducing interest rates in September. Falling interest rates are particularly welcome news for US small and medium sized companies as they are exposed to a higher proportion of floating rate debt compared to large companies.

Can the trend be sustained?

Extrapolating a short-term trend, based only on monthly data, far into the future, is not wise.

However, momentum seems to be with small and medium sized companies given the current and prospective macroeconomic background of steady economic growth, inflation back to target and falling interest rates. In the UK case, there is the added positive fact that small and medium sized companies have been trading at a discount to their international peers for quite a long period of time, thus representing a good entry point and buying opportunity.

That said, large companies, particularly US ones, still benefit from a good degree of market power and keep riding the Artificial Intelligence (AI) story which has been in favour with investors for quite some time. In addition, the current positive economic environment for small and medium sized companies could turn in case of a “growth scare” due to the pace of economic growth unexpectedly slowing down or if the price of oil jumped higher because of geopolitical developments in the Middle East.

As it is often the case, some degree of investment diversification, according to one’s risk appetite, across geographies, asset classes, large and small companies, is probably the best course of action for investors to follow.

Looking for financial Advice in Birmingham, London, or Warwick?

We focus on delivering high quality financial advice across a variety of areas.

From personal financial planning to ethical investing or advice on interest rates and stock market correlation, we are here to help.

So, if you are looking for an Investment Account Manager or Financial Planner in Birmingham, Warwick, or London, get in touch today. Call us on 01926 492 406.

Disclaimer

Any research is for information purposes only and does not constitute financial advice. The value of investments and any income from them may go down as well as up, so you may get back less than you invested. Past performance cannot be relied upon as a guide to future performance. KLO Financial Services Ltd are registered in the UK, company number 08711328. We are authorised and regulated by the Financial Conduct Authority, reference 710272. For any information please visit our website www.klofinancialservices.com