Taking AIM with Your Inheritance Tax Planning

No Change to the Inheritance Tax Regime

In the Autumn Budget Statement delivered on the 22nd of November, the UK Chancellor of the Exchequer was expected to pull a few policy rabbits out of the fiscal hat. Among them, there were rumours of a possible change to the Inheritance Tax (IHT) regime. Unfortunately, no magic happened in this regard, and this particular rabbit failed to materialise.

It is probably an understatement to say IHT is generally regarded by the public as one of the least popular taxes. In the memorable words of the former Labour Chancellor of the Exchequer, Roy Jenkins, it is “broadly speaking, a voluntary levy paid by those who distrust their heirs more than they dislike the Inland Revenue”.

Why this Could be a Problem

When referring to the financial impact of IHT, one often hears the refrain that it only affects roughly 4% of the population, hence it should not be of great concern for most households in Britain.

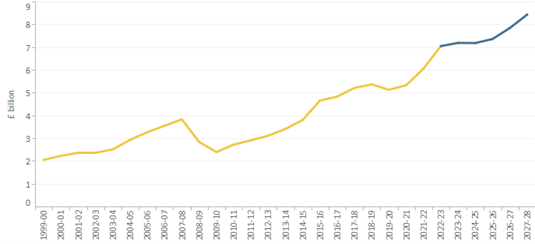

However, last year IHT raised £7.1billion, an all-time high amount, and according to projections by the Office for Budget Responsibility (OBR), the government spending watchdog, the sums raised by IHT are expected to climb even higher in the future.

What are the causes of the steadily ascent of IHT receipts, both in absolute terms and as share of the UK Gross Domestic Product (GDP), since 2009?

The answer is quite straightforward: rising asset prices, particularly residential properties. Average house prices rose by more than 70% between 2009 and 2022, and the threshold above which one can be subject to IHT has remained frozen at £325,000 since 2009.

Consequently, an increased number of estates have been subject, and likely will be subject, to paying IHT, which is why it is crucial for many households to think of ways to reduce their Inheritance Tax obligations.

How Could you Mitigate your IHT Burden?

With an increasing number of estates at risk of being impacted by an IHT liability in the future, accurate estate planning has never been more important. The help of expert and qualified advisers is paramount in providing holistic advice in the complex area of Inheritance Tax planning.

Among the various strategies and solutions which can help in this regard, a well-established approach tested over time is based on using an IHT portfolio service investing in the shares of eligible companies listed on the AIM market.

This strategy would enable investors who have remained invested continuously for over two years to pass on the wealth retained in their IHT portfolios to their successors without paying any inheritance tax.

Is it time to AIM higher?

AIM, formerly the acronym for the Alternative Investment Markets, is part of the London Stock exchange and has been around since 1995. It is currently home to about 850 companies with a combined market capitalisation of roughly £135 billion.

Companies at very different stages of their growth trajectory list on AIM, from adventurous start-ups to more established businesses.

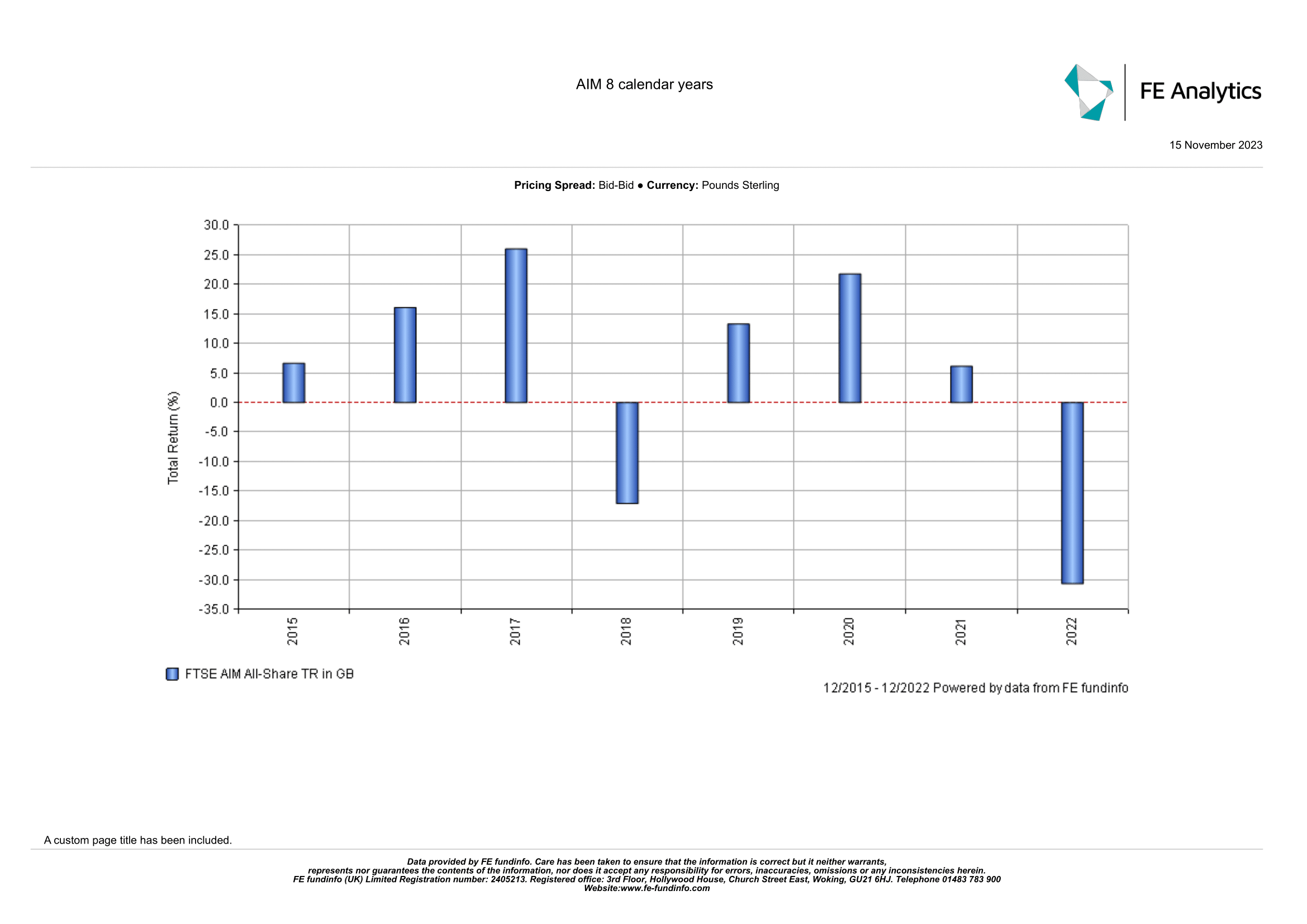

The AIM market has gone through a rough patch in 2022, with inflation at historic highs, a sharp rise in interest rates and the looming risk of an economic recession negatively impacting the share price of most of the companies listed on the index. Year-to-date performance has been far from stellar.

However, before 2022, the AIM market index delivered positive total return in GBP in 6 out of the previous 7 calendar years.

In case economic growth picks up some speed, in conjunction with abating inflation and the Bank of England ending its interest rates hiking cycle, the AIM market is increasingly looking oversold and could provide a good entry point, albeit the investor’s attitude to risk (and capacity for loss) should be in line with the expected, inevitable, high volatility of the index.

The Only Two Certainties…

As the saying goes, the only two certainties in life are death and taxes, and perversely they combine at the same time in the Inheritance Tax regime.

Hence the importance of professional estate planning with an expert Inheritance Tax advisor if one wishes to leave behind a financial legacy as well as many happy memories.

Speak to an Expert Financial Planner in Birmingham, Warwick, or London

Inheritance Tax is a complicated topic, and the best way to guarantee that you are mitigating your IHT burden effectively is by working with a qualified inheritance financial advisor.

Our experts understand the complexities of different taxes and will work diligently to ensure you minimise your tax expenditure. Our offices are based in Birmingham, Warwick, and London, so get in touch today by calling 01926 492 406 to find out how we can help you.

Disclaimer

Any research is for information purposes only and does not constitute financial advice. The value of investments and any income from them may go down as well as up, so you may get back less than you invested. Past performance cannot be relied upon as a guide to future performance. KLO Financial Services Ltd are registered in the UK, company number 08711328. We are authorised and regulated by the Financial Conduct Authority, reference 710272. For any information please visit our website www.klofinancialservices.com