An Energetic Old Lady – Commentary on Bank of England Interest Rates Hiking

A very challenging macroeconomic background

The Old Lady of Threadneedle Street, the nickname the Bank of England has been known by since the end of the 18th century, is in rude health and has taken a forceful action at the last meeting of its Monetary Policy Committee held on 2 November.

Faced with the prospect of inflation forecast to reach 10.9% by the end of this year, the Bank of England increased the Bank Rate by 0.75%, the single highest interest rate hike since 1989. The Bank Rate now stands at 3%, the highest level since 2008.

If financial markets are correct, the expectation is for the Bank Rate to climb up to “a peak of around 5¼% in 2023 Q3, before falling back “.

Should the expectation of financial markets be realised, the UK economy, as proxied by the real Gross Domestic Product (GDP), will contract by 1.9% in 2023 and by 0.1% in 2024.

As a consequence of falling economic activity, inflation, as measured by the Consumer Price Index (CPI), is expected to more than halve in 2023 from its forecast peak of 10.9% by this year end, and then to fall below the Bank of England medium term inflation target of 2%.

As there is no free lunch in economics, what is the price to pay for this very welcome expected fall in inflation? Rising unemployment, forecast to climb up from 3.7% by this year end to 5.9% in 2024.

What are the implications for financial markets?

Partly because of the turmoil following the announcement of the unfunded tax cuts contained in the mini budget released last September, yields on UK government debt (gilts) have become more attractive.

With the UK economy probably already in recession and expected to remain in recession in 2023 and 2024, as forecast by the Bank of England, gilts could re-establish a negative correlation with equity and increase in price (yields falling), playing the role of “safe heaven” assets.

The risk is that in case the fall in economic activity fails to damp inflation, the Bank of England will be forced to keep raising interest rates and yields on UK government debt could soar once again (prices falling).

In addition, the Bank of England has embarked on a program of so-called “Quantitative Tightening”, the reverse of its previous program of “Quantitative Easing”, meaning it has started selling UK government bonds held in its portfolio of assets. This will increase the supply of UK government debt on the market, and in case there is not enough demand on the part of investors for this increased supply, the price of gilts is expected to fall (yields rising).

Last but not least, “bonds vigilantes” will keep a watchful eye on the fiscal measures included in the forthcoming UK government Autumn budget statement in terms of the medium to long term sustainability of public finances.

Should any doubt arise as regards fiscal rectitude, a sell-off of gilts could well happen, piling downward pressure on their prices.

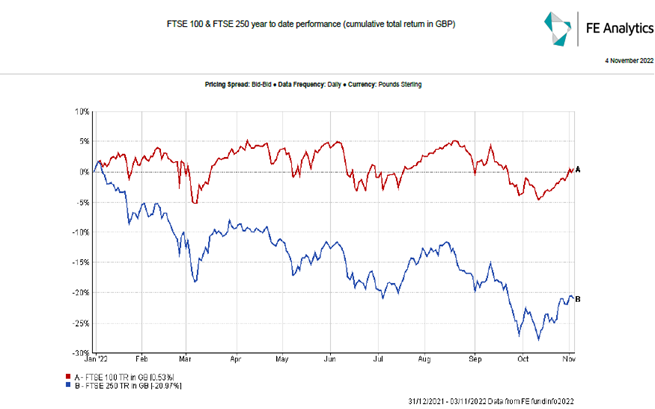

Recessionary risks have already taken a heavy toll on small and medium size businesses that generate most of their earnings domestically, as evidenced by the FTSE 250 index entering “bear market” territory, having fallen by more than 20% year to date.

In addition, soaring mortgage rates threaten households’ disposable income, with likely negative effects on companies’ earnings due to reduced consumption of goods and services and a weakening housing market.

By contrast, the FTSE 100 index has managed to remain just about in the black in terms of total return year to date.

This is mostly a function of two elements: 1) the vast majority of earnings of companies listed on the FTSE 100 index are generated abroad, mostly booked in US dollars and Euros, therefore becoming more valuable once translated back into a weaker pound sterling. This in turn allowed at least some companies to resume and other to increase their dividend payments to shareholders; 2) companies operating in the oil & gas and extractive resources sectors, which have benefited from the high cost of energy and commodities, form the bulk of the listings on the FTSE 100 index.

Most companies listed on the FTSE 100 index also operate on a wide international scale, therefore are more insulated from the repercussions of a purely UK economic recession.

That said, there are signs a deep economic recession in the UK could be part of a more widespread global recession and in that case the profitability of large companies will be severely dented as well, due to collapsing demand, likely including companies operating in the commodity and the oil & gas sectors.

The temptation to liquidate all financial assets and move to cash is high, especially given rising interest rates.

However, this assumes it might be easy to “time the market”, when it is more likely instead that investors will end up selling at the lowest price and subsequently buying at the highest price should markets rebound strongly, especially because financial markets are often subject to “overshooting” and price action tends to take place suddenly and in concentrated periods of time, closely clustered together.

Markets are forward looking and tend to turn before the final depth of any recession is reached, and probably a good deal of bad news has already been priced into the market action of many companies’ shares.

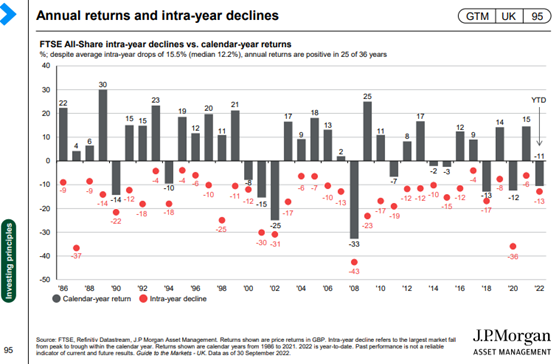

That said, the sheer volume of negative news headlines can be overwhelming for investors to bear psychologically; still, if history is any guide, long term investments are likely to be rewarded. As shown in the below chart of annual returns on the FTSE All Shares Index, a good measure of the overall UK equity market, despite average intra-year drops of 15.5%, annual returns have been positive in 25 out of 36 years, i.e., an almost 70% frequency probability of obtaining a positive return in a full calendar year by remaining fully invested:

How can KLO help?

At KLO Financial Services, we have an expert team of independent financial advisers in Birmingham, Warwick and London, who can support you with seeing the best return on your finances – from portfolio diversification, investing decisions and personal financial management.

Want to make sure you’re managing your money effectively? Our team of financial advisers would be happy to help. Get in touch on 01926 492406 or email enquiries@klofinancialservices.com.

Disclaimer

Any research is for information purposes only and does not constitute financial advice. The value of investments and any income from them may go down as well as up, so you may get back less than you invested. Past performance cannot be relied upon as a guide to future performance. KLO Financial Services Ltd are registered in the UK, company number 08711328. We are authorised and regulated by the Financial Conduct Authority, reference 710272. For any information please visit our website klofinancialservices.com