If You Bought 30 Years Ago Today…

30 years ago, traders were having a bad day: all the main indices worldwide were falling, the Dow, S&P 500, FTSE 100, DAX and CAC falling -23%, -20%, -11%, -9% and -10% respectively. The FTSE 100 fell a further 12% the day after, reflecting the difficulties in fully reopening the market after the great storm that had struck the UK a few days earlier.

The day, 19th of October 1987, would eventually become known as Black Monday.

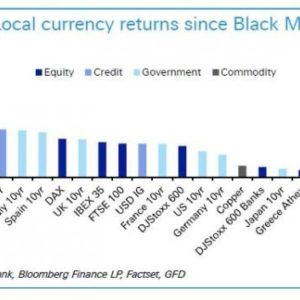

Deutsche Bank’s credit strategist, Jim Reid, decided to calculate where returns would be today had you bought various assets the morning after the crash. He notes that the most important decision to have made was whether to buy the S&P 500 or the Nikkei back in October 1987. The former tops the charts and has returned +2123% (+10.9% pa) since whereas the latter is at the bottom of the pile returning a meagre +12% (+0.4% pa). These are local currency returns but even if you were currency-hedged, the Nikkei still only returned a relatively small +41% (+1.1% pa).

Another interesting observation: outside of the Nikkei, the three bottom performers have been commodity-based with the CRB index (+60%, +1.6% pa), Oil (+163%, +3.3% pa) and Gold (+166%, +3.3% pa). As Jim Reid points out:” This shows how difficult it is for commodities to keep up over time with income-producing securities with compounded interest or dividend reinvestment”.

Considering the turmoil around the Euro Sovereign Crisis, it’s impressive that Italian and Spanish Government bonds make the top 5 performers in local currency terms returning +1086% (+8.6% pa) and +1037% (+8.4% pa) respectively over the period. Obviously, the Euro convergence story from very high starting yields and in later years ECB bond purchases have provided the impetus here.

Meanwhile, US High Yield bonds investors can claim to lead the way in fixed income returns with a +1106% (+8.7% pa) return over the period.

The following chart shows the full list of performers over the period, in local currency terms:

The moral of the story is, even in the darkest hour of financial markets stress, it pays to invest long term and try to weather the storm.

If you’re looking for financial advice regarding investment planning, talk to our financial advice team. Please call on 01926 492406 or email us at enquiries@klofinancialservices.com to make an appointment.