Can “It” Happen Again?

Could we see another financial crisis?

In 1982 the American economist Hyman Minsky published a series of academic papers and articles bound together in a book titled “Can it happen again?”.

The “it” in the book title referred to the repetition of a financial crisis centred in the US banking system which Minsky hypothesised was the principal cause of the Great Depression of 1929.

Then, in 2008-2009, the world was struck by the Global Financial Crisis (GFC). In its wake, it followed more than a decade of historically low interest rates and abundant liquidity in financial markets, courtesy of expansionary monetary policies implemented by the major central banks.

By the end of 2021 and the beginning of 2022, inflation was at a 40 year high on the back of exploding energy and food prices following the Russian invasion of Ukraine, forcing central banks around the world to embark on an accelerated interest rates hiking cycle, reversing the secular downtrend movement in bonds yields. The latter started soaring (prices falling) at an extraordinary pace, inflicting capital losses on bondholders.

The pace of restrictive monetary policy implementation has been unprecedented so far, especially in the US, where the Federal Reserve (Fed) increased the federal fund rate 8 times in the space of just 9 months between March and December 2022, raising it from a historically low 0.25% to 4.75%.

It is common wisdom in financial circles that, traditionally, the FED usually initiates an interest rate hiking cycle and keeps going until something “breaks”.

In the view of FED officials, the labour market is expected “to break” because of the economy markedly slowing down and possibly falling into recession because of the interest rate hiking cycle. This, in turn, should help in reducing demand-led inflation.

However, as the law of unintended consequences took hold, on March 10th what broke down was, once again, a depository institution, namely, the US-based Silicon Valley Bank (“SVB”), the biggest bank to fail since the GFC.

Higher interest rates caused a significant loss on the bank’s portfolio of bonds at the time they were sold to raise cash to cover deposit withdrawals by SVB’s clients, mainly venture capital-backed companies and start-ups.

After the bank failed to raise capital worth US$ 1.8 billion by selling the company’s shares and with deposit withdrawals intensifying, the liquidity crisis suddenly became an insolvency one.

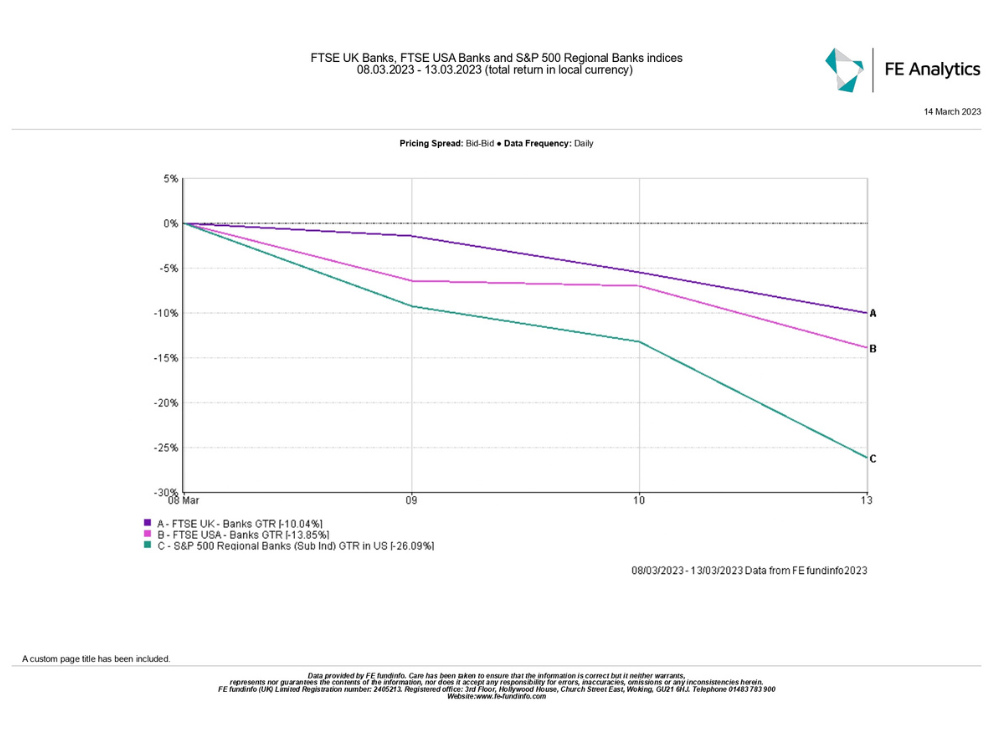

That something was afoot was probably surmised by at least some investors, with banks’ share prices already falling before the SVB insolvency event, which then, in turn, intensified the sell-off:

Financial Contagion?

Given the highly interconnected nature of financial and banking systems, the fear is that SVB’s insolvency could have a knock-on effect on other financial institutions and markets, generally spreading the crisis.

Another depositary institution went into insolvency immediately after SVB, namely the American, New York-based, Signature Bank, active in the cryptocurrency sector.

However, authorities in the US were quick to react, with the Federal Deposit Insurance Corporation (FDIC) cap of US$250,000 cover per account holder, per bank removed, to try and protect all deposits holders and prop the viability of businesses holding accounts at SVB, albeit the actual amount of money recovered for uninsured depositors will be determined by the sums raised by the regulator after selling the remaining SVB’s assets.

At the same time, the Fed has set up a new funding facility, namely the Bank Term Funding Program, to provide extra liquidity to any financial institutions which might need it, offering loans of up to 1 year in exchange for high-quality collateral such as US Treasury bonds accepted at face value.

In the UK, the British financial subsidiary of SVB has been acquired by HSBC, after the mediation of the Bank of England and the UK Treasury.

Overall, the measures quickly implemented by the authorities in the US and UK appear to have been effective, to reassure investors and provide a rapid resolution to the crisis, especially considering neither SVB nor the Signature Bank were “systemically important” depositary institutions, i.e., banks whose failure could pose a major risk to the financial system because of their sheer size and global interconnectedness.

What lessons can be learnt?

Some critics have pointed out that at the core of the SVB’s insolvency is a regulatory failure, namely the fact that since 2018 smaller regional banks were exempted from more stringent regulations in terms of risk monitoring and stress testing compared to the major banks.

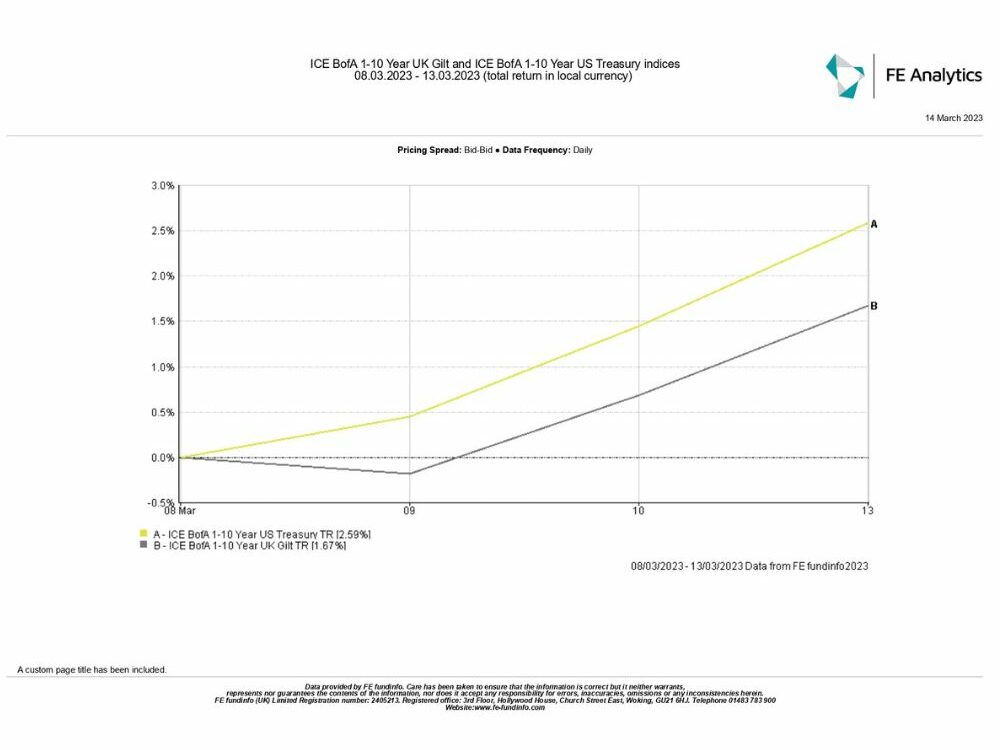

Whilst banks’ shares were undergoing a sharp sell-off, government bonds both in the US and the UK maintained their value and provided positive returns as investors fled to the perceived “safe haven” nature of these assets in a crisis:

Financial markets are inherently risky and volatile, and the most important lesson one can draw from this episode is probably the importance of asset class diversification when it comes to investing for the long term.

Financial Advisers in Birmingham, London and Warwick

At KLO Financial Services we specialise in providing our clients with tailored financial services in Birmingham, Warwick, London.

Our solutions focus on everything from personal financial planning to investment planning, business protection solutions and more, with our team of IFAs ready to help you.

Get in touch with our Birmingham, Warwick and London based financial advisors today. Call us on 01926 492 406!

Disclaimer

Any research is for information purposes only and does not constitute financial advice. The value of investments and any income from them may go down as well as up, so you may get back less than you invested. Past performance cannot be relied upon as a guide to future performance. KLO Financial Services Ltd are registered in the UK, company number 08711328. We are authorised and regulated by the Financial Conduct Authority, reference 710272. For any information please visit our website www.klofinancialservices.com