Dictum Meum Pactum

I Owe You

Dating back to the early 19th century, “Dictum Meum Pactum’, which is translated from the language of Virgil and Cicero as ‘my word is my bond’, is the motto of the London Stock Exchange. The latter is the temple of companies’ shares trading. However, the motto applies equally well, if not better, to fixed interest assets which being essentially IOUs, are based on the trust established between lender and debtor, with the borrower pledging his word to pay interest at regular intervals and to return the borrowed principal at maturity.

Since the Global Financial crisis of 2008-2009, yields on UK and especially US government debt and, partly, on investment grade corporate debt have been on a downward trajectory (prices increasing), albeit along a volatile path.

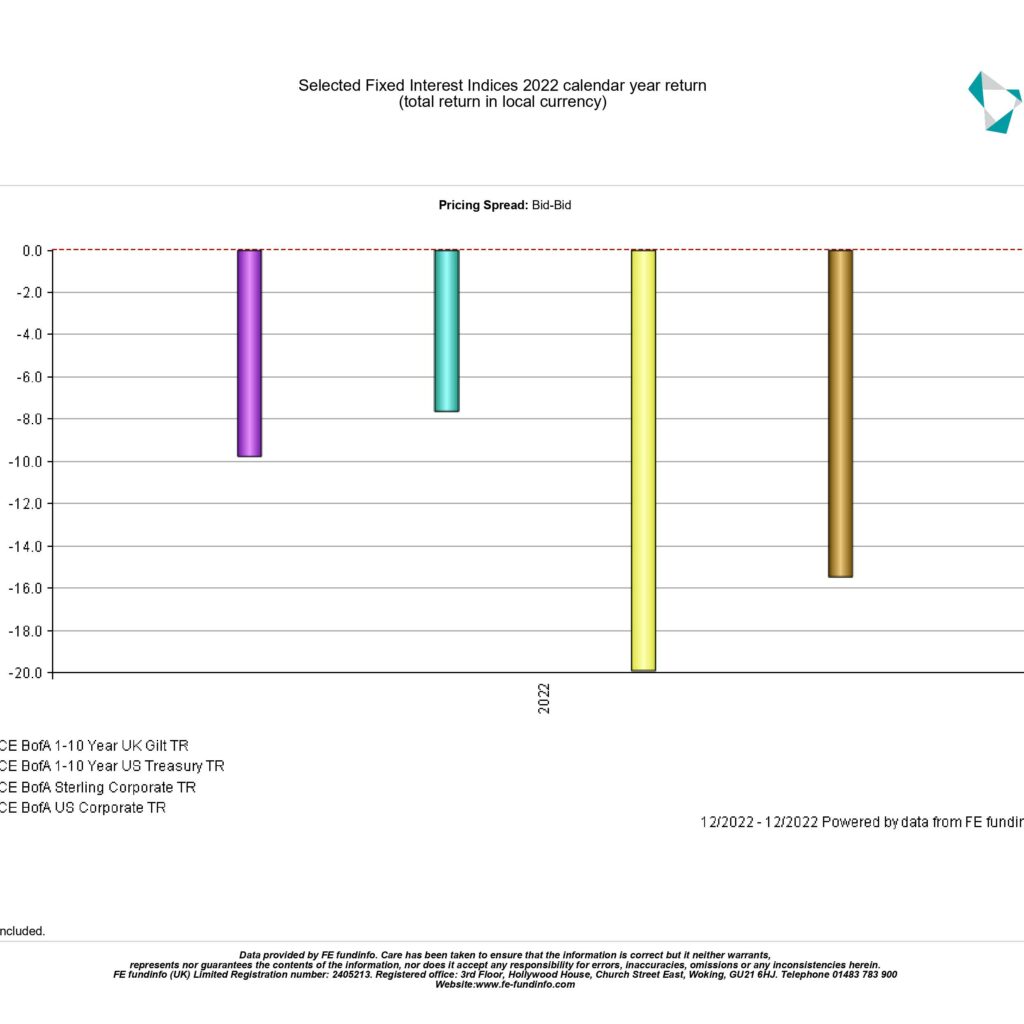

In 2022, the toxic combination of inflation at 40 years high on the back of exploding energy and food prices following the Russian invasion of Ukraine, coupled with central banks across the world embarking on an accelerated interest rates hiking cycle, reversed this secular downtrend movement in yields. The latter started soaring (prices falling) at an unprecedented pace, inflicting capital losses on bondholders.

In the specific case of the UK, the adverse macroeconomic environment weighing on bonds was exacerbated by policy errors such as the ‘Mini-Budget’ delivered on the last week of September 2022, featuring a string of unfunded tax cuts which spooked investors, worried about the long-term fiscal sustainability of UK public finances, with consequent sell-off of government debt.

At one point in October 2022, the yield on the 10-year UK Gilt jumped to almost 4.5%, a level not seen since the Global Financial Crisis of 2008-2009.

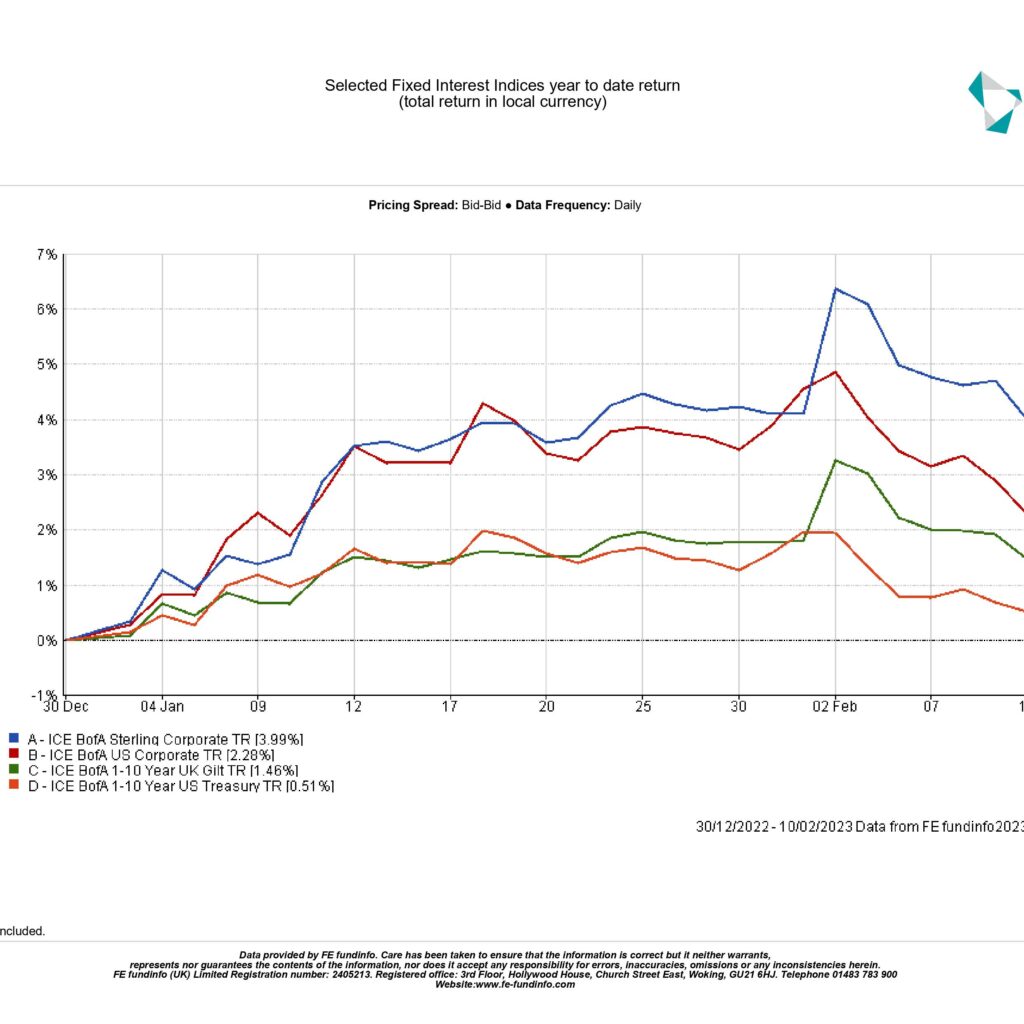

Investors’ expectations that inflation has reached its peak and, as a result, central banks will soon pause their interest rates hiking cycle, having been a tailwind for bonds so far this year, mostly corporate debt:

Why Bonds?

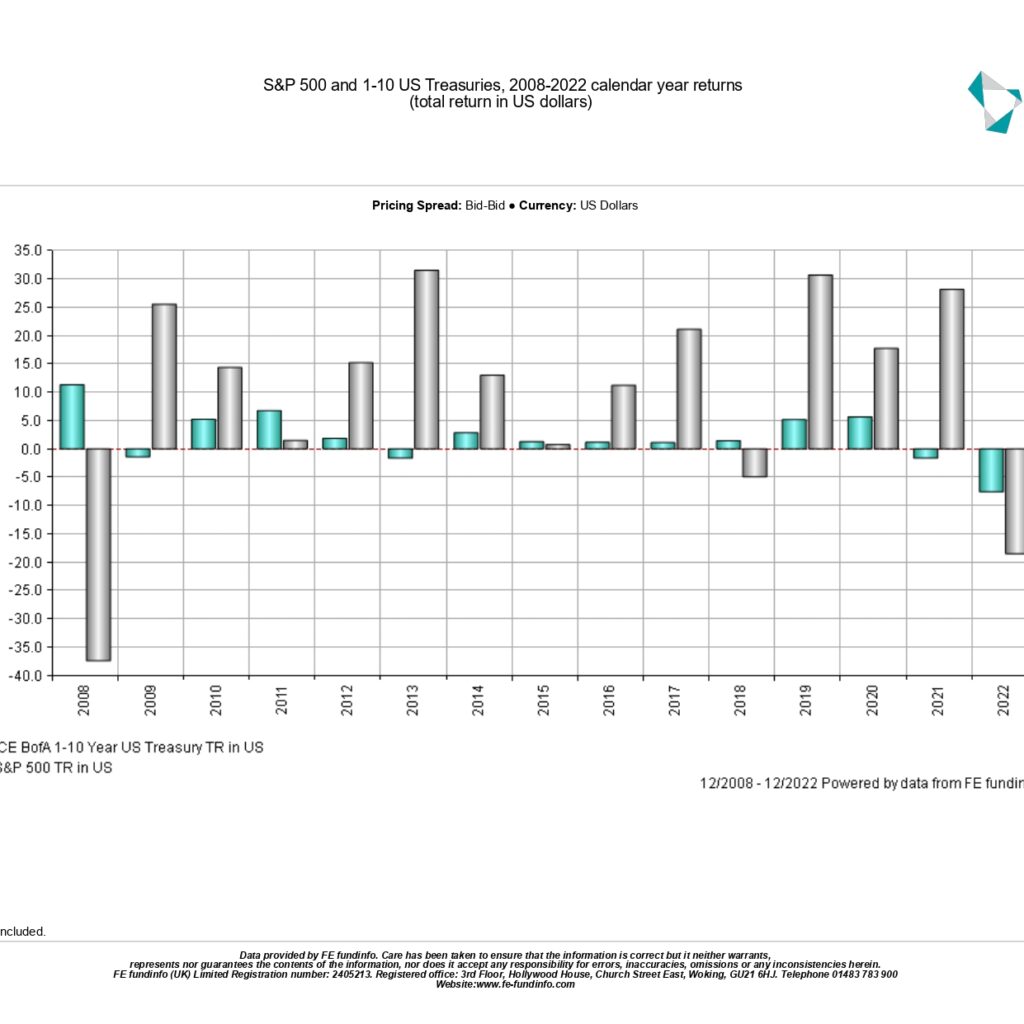

The traditional rationales for holding bonds in investment portfolios are essentially; income generation and portfolio diversification. The latter, in particular with reference to government debt, is predicated on the expectation of a negative correlation of price returns between government bonds and risky assets, specifically equity, i.e., on the anticipation that when equity prices fall, the price of government debt might increase, remain stable or fall much less, thus providing ballast to investment portfolios.

Why should that be the case? In times of economic distress such as during recessions, earnings and profit margins compress and companies’ share prices would likely fall, thus prompting investors to rush into the perceived safety of government debt.

As can be evinced from the below chart for the US, financial history tells us that this negative correlation of price returns between equity and government debt played an important role during the Global Financial Crisis of 2008-09.

However, the chart also shows that in 2022 the price returns correlation turned strongly positive, i.e., the prices of both equity and fixed interest assets moved together in the same direction: down, falling in unison.

This is mainly the reason why 2022 proved to be such an “annus horribilis” for investors, no place to hide, and virtually no ballast in investment portfolios:

Where do we go from here?

It really felt like there was no place to hide for investors, unless one had exposure only to the oil & gas, coal and energy complex in general which benefited from the high price of hydrocarbons, with the S&P 500 Energy sector index, for instance, returning over 90% in GBP by the end of November since the start of the year.

During the course of 2022 stock markets in the UK performed in a binary way,

The FTSE 100 index posted a positive performance, thanks to the bulk of the international large companies listed on it operating in the oil & gas, commodities and basic material sectors that all benefited from the soaring price of energy and inflation levels at historic highs.

On the other hand, medium and small cap companies, more domestic oriented, were heavily impacted by the negative effects of the “permacrisis”, as exemplified by the performance of the FTSE 250 index losing more than 16% by the end of November.

Similarly, the 10-year UK Gilt (government debt) started the year yielding just below 1% and jumped to a yield of over 3% by the end of November (price falling), causing a capital loss for bondholders of roughly 20%.

The jump in yield was particularly concentrated in the immediate aftermath of the “mini budget” released by the UK government on 24th September, featuring a string of unfunded tax cuts which spooked investors as regards the fiscal sustainability of UK public finances.

Investors, both domestically and internationally, took fright and dumped UK government debt en masse, causing yields to skyrocket (prices falling) from 3.50% to 4.51% by the 27th of September, prompting the following day an extraordinary intervention by the Bank of England that announced it would carry out temporary purchases of long-dated UK government bonds to the tune of £65billion to alleviate liquidity problems in the pension industry.

The jump in government bond yields also negatively affected the housing market via a knock-on effect on mortgages, with mortgage lenders withdrawing many deals from the market only to be replaced by mortgages with higher interest rates. House prices fell by 2.3% nationwide in November, according to mortgage lender Halifax. This was the largest monthly fall since the beginning of the Global Financial Crisis in 2008.

Last but not least, the effect of the fiscal measures contained in the mini budget was also acutely felt in the foreign exchange market with the pound falling from 1.12 vs. the US dollar to only 1.03 vs. US dollar, an all-time historic low for the British currency.

Thankfully, following the Autumn Statement released on November 17th featuring a more balanced fiscal policy approach, capital markets stabilised, yields on government debt started falling (prices rising) and the pound started regaining ground vs. the US dollar and has been strengthening considerably since then, with one pound now buying 1.22 US dollars.

On the one hand, this should unclog international supply chains and be disinflationary. On the other hand, a Chinese economy at full throttle would be a gigantic consumer of basic materials and energy, which could prove to be inflationary.

Persistent high inflation would force central banks to remain “hawkish”, i.e., to keep interest rates higher for longer, and the combination of high inflation and rising interest rates is kryptonite for fixed-interest assets.

On balance, the prospects for fixed-interest assets have improved compared to 2022, especially in terms of portfolio diversification potential. However, there are also risks that investors should be aware of, and one must be ready to ride the inevitable volatility.

Financial Advisers in Birmingham, London and Warwick

At KLO Financial Services we specialise in providing tailored financial solutions to our clients.

Focusing on everything from independent pension advice to personal financial planning, investment planning and more, our dedicated team of experts are ready to help you.

If you are looking for support from an IFA in Warwick, London or Birmingham, get in touch with our specialists today. Call us on 01926 492406!

Disclaimer

Any research is for information purposes only and does not constitute financial advice. The value of investments and any income from them may go down as well as up, so you may get back less than you invested. Past performance cannot be relied upon as a guide to future performance.

KLO Financial Services Ltd are registered in the UK, company number 08711328. We are authorised and regulated by the Financial Conduct Authority, reference 710272. For any information please visit our website www.klofinancialservices.com