Are We Experiencing Economic Malaise?

According to the Office for National Statistics, the UK real Gross Domestic Product (GDP), a measure of the final value of products and services delivered by the economy, is estimated to have fallen by 0.3% between October and December 2023, following a previous fall of 0.1% between July and September 2023.

Hence, the UK economy has entered recession, defined in technical terms as two consecutive quarters of negative real GDP growth.

Fall in the output of the services sector, as well as declining industrial and construction production, were the main drivers of the economic underperformance, with both households and the public sector reining in expenditure and imports exceeding exports.

Too Much Gloom, Perhaps

However, investments by businesses have increased by the end of 2023, unemployment is still very low by historical standards, wages have increased in real terms, thanks to a steady fall in inflation, and this makes the overall picture less dire and points towards a shallow recession that should be quickly reversed in the next few months.

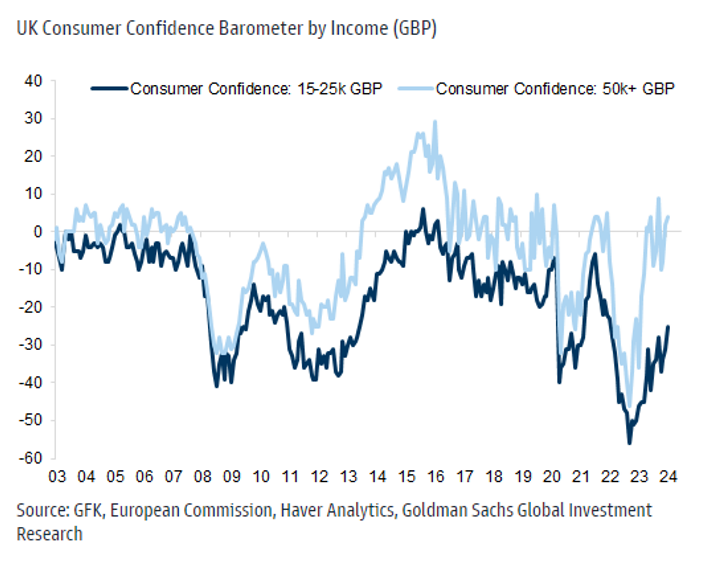

Better than expected numbers on the headline inflation front, with the latest reading of the Consumer Price Index (CPI) at 4%, have also helped consumer confidence recovering, albeit from a low base:

While the economy has now decreased for two consecutive quarters, GDP across 2023 is estimated by the Office for National Statistics to have marginally increased by 0.1% compared with 2022.

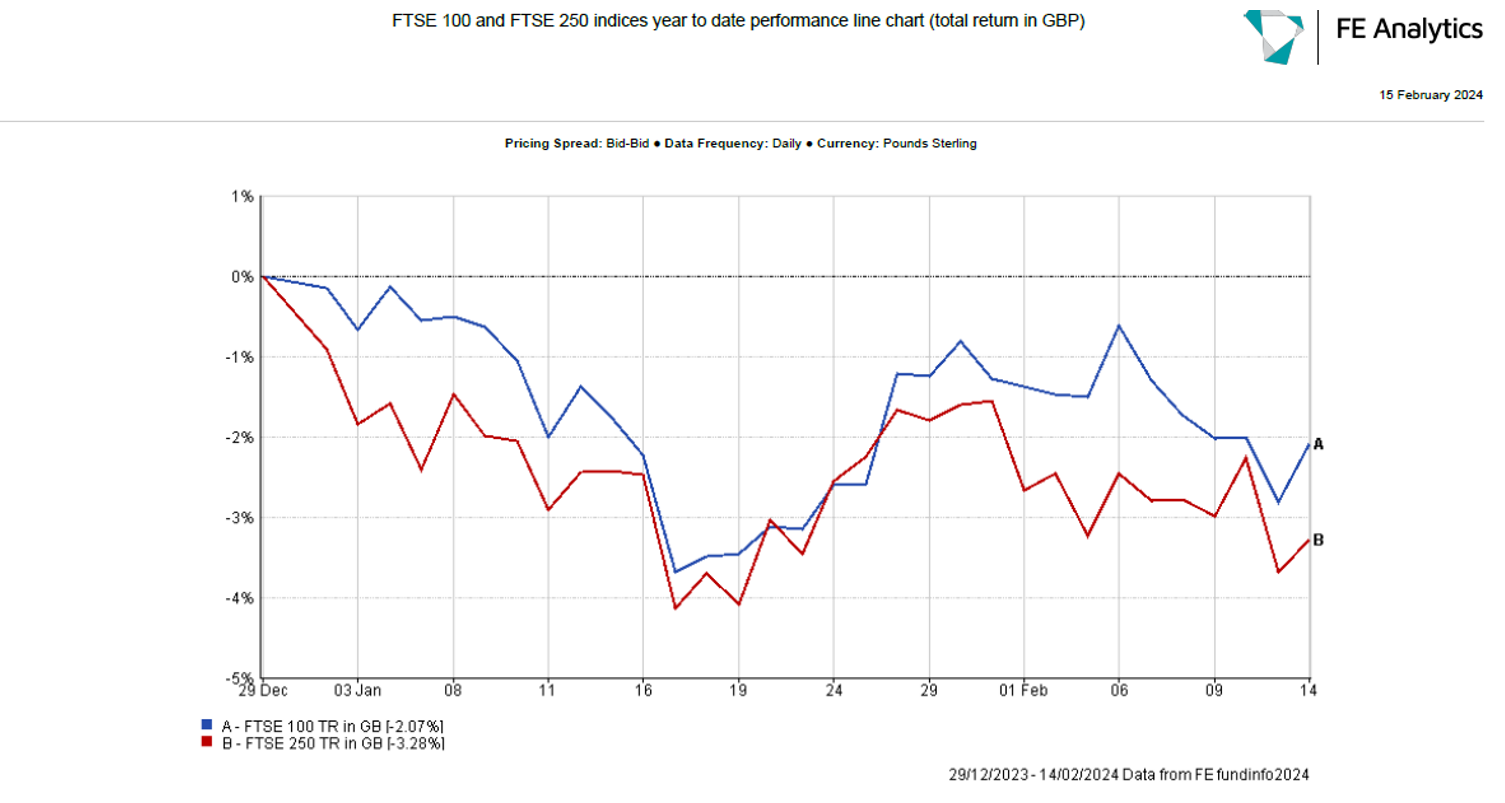

The anaemic economic growth notwithstanding, the FTSE 100 index and the FTSE 250 index both posted a total return of about 8% in the calendar year 2023.

That said, economic weakness seems to be affecting UK stock markets recently, with both the FTSE 100 index and the FTSE 250 index sputtering in terms of performance year to date:

The forthcoming 6th March government budget, thought to likely feature pro-growth measures such as tax cuts, and the Bank of England expected to start cutting interest rates by June at the latest, could be the needed catalysts to revive the economy and should probably help improve investors’ sentiment for the rest of the year.

Speak to a Financial Adviser in Birmingham or Warwick

At KLO Financial Services we focus on providing our clients with tailored financial solutions across a variety of areas including investment diversification, personal finances, and tax planning.

We have a dedicated team ranging from personal financial advisers to investment analysts and chartered financial planners.

So, if you are looking for local financial advice around Birmingham or Warwick then get in touch with us today. Call us on 01926 492406!

Disclaimer

Any research is for information purposes only and does not constitute financial advice. The value of investments and any income from them may go down as well as up, so you may get back less than you invested. Past performance cannot be relied upon as a guide to future performance. KLO Financial Services Ltd are registered in the UK, company number 08711328. We are authorised and regulated by the Financial Conduct Authority, reference 710272. For any information please visit our website www.klofinancialservices.com