Understanding the Impact of Retaliation Tarriffs on the Stock Market

It is undeniable that the announcement of so-called “retaliatory tariffs” by the new US administration at the time of the self-proclaimed “Liberation Day” on the 2nd of April sent shock waves across the global economy and financial markets.

A trend of weakened and volatile market performance has been underway since the second half of February turned into a sustained market sell-off, inflicting losses particularly on US stocks and bondholders. The onset of what looked like an international tariff war felt like a seismic shift.

What can history teach us when it comes to financial markets having to face sudden shocks? Should investors liquidate all their holdings and perhaps hold only cash?

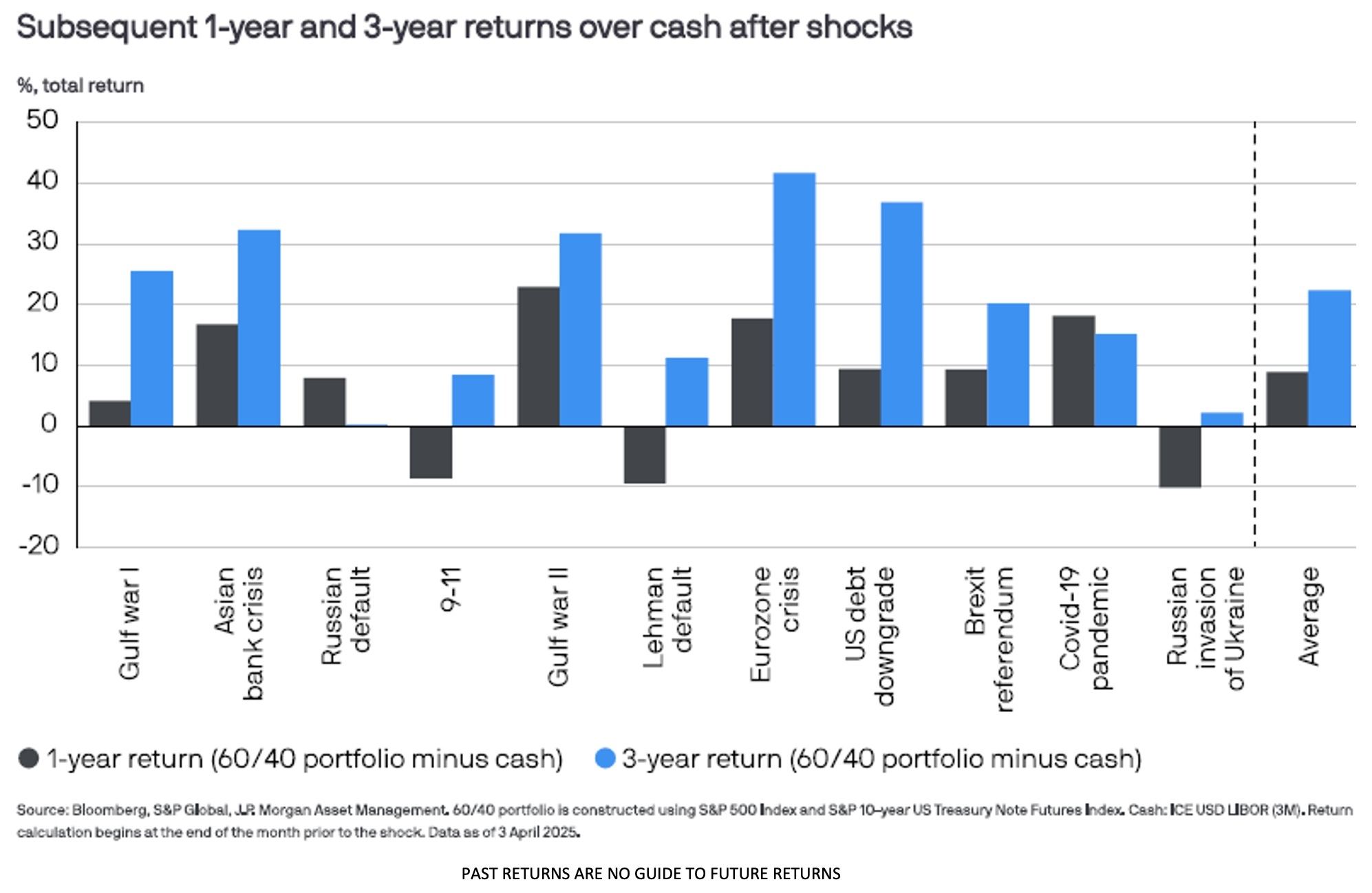

As the below chart produced by the research team at JP Morgan Asset Management shows, since 1990-91 (1st Gulf War) cash has always underperformed a balanced and diversified portfolio over a 3 years horizon after a major shock, whatever its origin (financial, political, international terrorism, public health-related etc.), and outperformed only on 3 occasions over 1 year after the shock:

The foregoing seems to reinforce the points that, the current shock to international trade due to tariffs notwithstanding:

- Shocks strike usually out of the blue (“unknown unknowns”), hence geographic and asset classes diversification is important and selling out after the event only crystallises losses and impairs the potential recovery of the investment portfolio over the medium term.

- Outsized gains tend to happen in clusters and to be concentrated over particular periods; hence, being out of the market and missing out on those days when financial markets suddenly jump higher can be costly.

- Over the medium to long term, a combination of bonds and equity (to various degrees, depending on individual risk appetite and capacity for loss) outperforms cash.

Overall, financial history seems to suggest time is on the investors’ side; hence, no panic, keep calm and carry on with your financial planning.

Disclaimer

Any research is for information purposes only and does not constitute financial advice. The value of investments and any income from them may go down as well as up, so you may get back less than you invested. Past performance cannot be relied upon as a guide to future performance. KLO Financial Services Ltd are registered in the UK, company number 08711328. We are authorised and regulated by the Financial Conduct Authority, reference 710272. For any information, please visit our website www.klofinancialservices.com.