The Effect of Trump Tariffs on the Stock Market

The Effect of Trump Tariffs on the Stock Market

Amid the flurry of executive orders released by the newly elected US president Trump, the risk of trade wars has increased due to the imposition of international tariffs. The frenzied political activity surrounding the Russia-Ukraine conflict, along with a brewing Transatlantic diplomatic rift between the US and Europe, has added to the uncertainty.

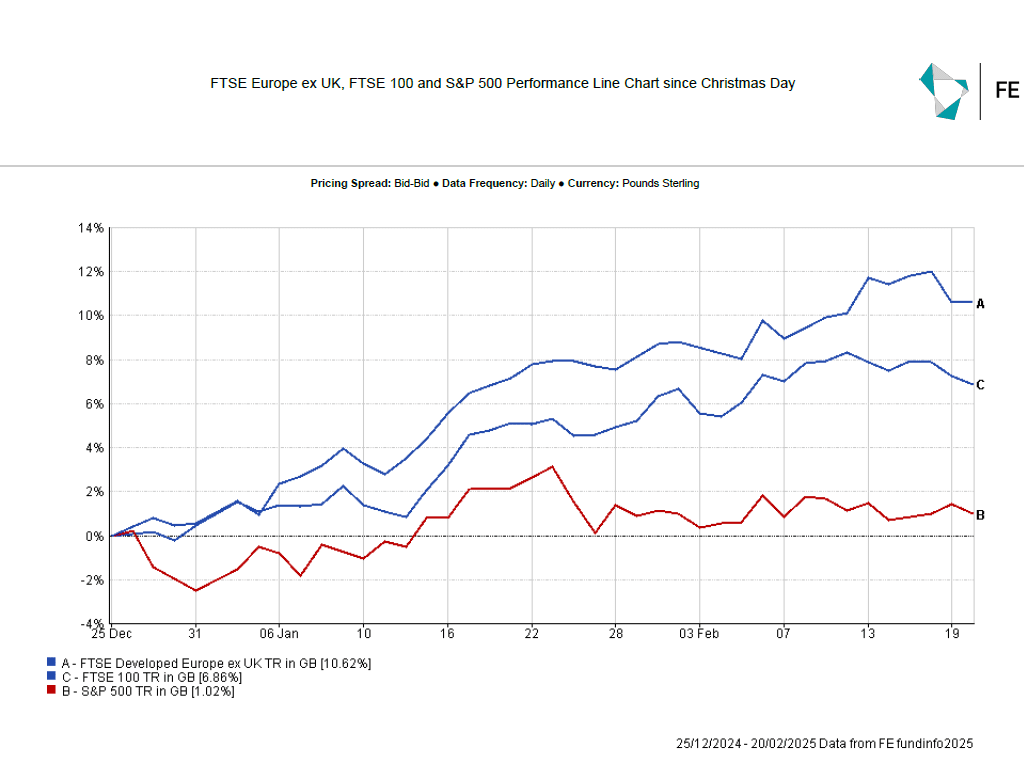

Given these developments, one might be excused for overlooking the outperformance of the European and FTSE 100 stock market indices compared to the US S&P 500 index of large companies in recent months.

What is the Effect of Tariffs on the Stock Market?

A combination of factors seems to have contributed to this outperformance.

Many European companies have reported robust results in the last three months of 2024, with healthy increases in earnings and sales. This marks the highest growth rate since the end of 2022, despite political uncertainty in Germany and France, as well as stagnating economic growth in those countries.

This growth has been partly driven by a weakened Euro against the US dollar, which has helped export competitiveness. A rebound in the luxury goods and banking sectors has also contributed. Additionally, there is an expectation of increased profitability for weapons manufacturers due to the uncertain geopolitical outlook.

Add to the mix the steady path, at least so far, of interest rates reduction on the part of the European Central Bank, with five interest rates cuts in seven months, to stimulate economic growth.

A bout of strength of the US dollar vs. the pound has also benefited the performance of the FTSE 100 stock market index, as companies listed on it generate around ¾ of their revenue abroad, hence taking advantage of a weaker pound both in terms of export competitiveness and when translating their revenues back from foreign currency (mainly the US dollar) into pounds.

European and UK stock markets have been markedly undervalued compared to the US S&P 500 equity index of large companies for some time, hence providing investors with the opportunity of buying shares of excellent companies at attractive valuations.

In addition, the performance of the US S&P 500 equity index has been driven mainly by the share price action of a very narrow sets of companies, the so-called “Magnificent 7”, at the forefront of the Artificial Intelligence (AI) theme. However, the latter has been shaken somewhat by the recent launch of a cheap and, apparently, energy efficient, Chinese AI product named Deepseek, foreshadowing the rise of strong competition to the established players in the AI space.

Given the current high valuations of the shares of US companies involved in the AI race, some international capital has started to flow towards stock markets far less reliant on technology companies for their performance, such as the European and UK ones.

How Could Tariffs Affect the Stock Market in Future?

If the current trend will persist or if the US stock market is simply catching its breath before resuming a steady ascent, maybe boosted by the tax cuts and deregulation agenda of the Trump administration, is impossible to predict, and herein lies the moral of the story, namely that a reasonable geographic diversification when it comes to equity investing is usually a very sensible approach.

Looking for expert advice from a local financial adviser?

At KLO Financial Services, we offer expert personal financial planning, financial portfolio management and investment diversification strategies.

Our team of independent financial advisers keep on top of all the news impacting your money such as the tariffs and stock market, and are here to help you plan and secure the life you want and deserve.

To speak to one of our personal financial advisers in Birmingham and Warwick, call 01926 492406 or email enquiries@klofinancialservices.com

Disclaimer

Any research is for information purposes only and does not constitute financial advice. The value of investments and any income from them may go down as well as up, so you may get back less than you invested. Past performance cannot be relied upon as a guide to future performance. KLO Financial Services Ltd are registered in the UK, company number 08711328. We are authorised and regulated by the Financial Conduct Authority, reference 710272. For any information please visit our website www.klofinancialservices.com