Investing For The Long Term

It has been a tumultuous and eventful start to the year, with no shortage of negative headlines.

From the return of large-scale conventional war in Europe for the first time since 1939 to rampant inflation at levels not seen for 30 and 40 years in the UK and the US, with the accompanying “cost of living crisis”, and central banks of developed countries hiking interest rates.

Throw into the mix the resumption of lockdown measures in part of China, with the Chinese authorities aiming at implementing a “Zero Covid” policy.

How has this impacted the market?

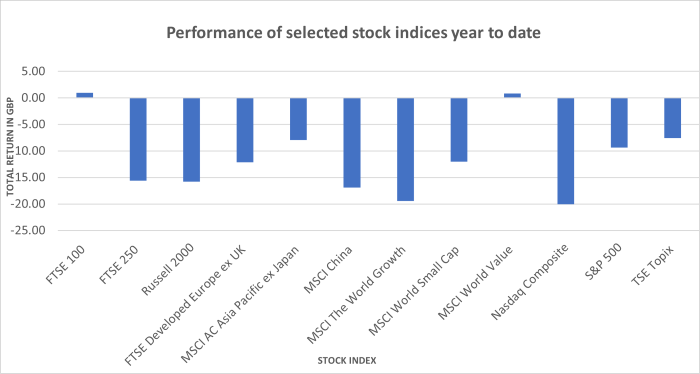

Unsurprisingly, this stream of negative news has been reflected in the performance of main stock market indices year to date, as evidenced below:

The FTSE 100 is the only major stock market index, together with the “value” style of investment, which has managed to remain barely in the black year to date. It benefited from the current economic background, thanks to companies in the oil & gas, basic materials, and mining sectors that are listed on the index taking advantage of the high prices of energy and commodities.

Large cap companies within sectors of the “old economy” roaring back.

However, even in the UK, the FTSE 250 index listing small and mid ap companies lost more than 15% year to date.

How has this impacted investors?

To compound investors’ misery, yields on government debt as well as on most corporate debt, especially in the US and the UK, have jumped high (prices gone down) to levels not seen in many years.

Hence, the traditional 60/40 investment portfolio of stocks and debt has not been able to provide much cover.

Given the high volatility, it is no wonder new potential investors might feel doubtful about committing new capital to financial markets. Current investors too might start feeling a bit nervous and maybe thinking about liquidating their holdings and going back to cash, waiting for calmer markets.

Under these circumstances, it springs to mind the Churchillian remark made during the tough days of WWII, “never let a good crisis go to waste”.

The current market setting might represent an opportunity to invest in many areas of the market which have become cheaper, with the chance of buying shares of great companies at better, lower prices, either directly or via collective investment schemes.

This does not need to be done necessarily all at once, i.e.by investing a lump sum.

New and current investors can take advantage of falling markets by drip-feeding cash into their investment portfolios on a regular basis.

Thanks to the securities falling in price, regular purchases would allow investors to buy more units or shares in return for their contributions (an investment technique known as “pound cost averaging”).

Most importantly, the history of financial markets has taught all investors, old and new, potential, and current, a clear lesson.

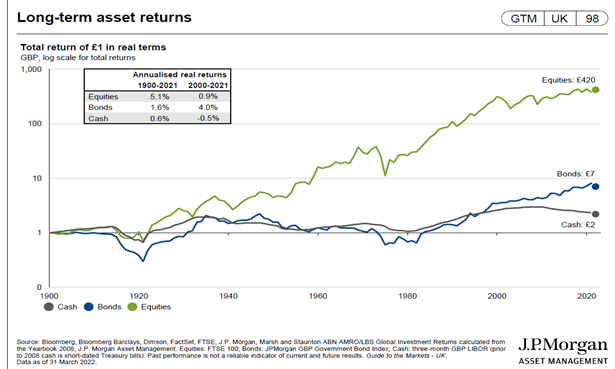

As evidenced by the below chart, the wisdom of markets as opposed to the madness of crowds seems to be showing that investing should be a long-term commitment.

To wit, £1 invested in traditional financial assets such as stocks and bonds appears to have a greater likelihood of outperforming returns from cash over a medium to long term horizon:

Maybe “this time is different” and the best option is to remain in cash and disinvest?

Apart from the obvious limitations of this approach in a regime of high inflation, which chips away at the value of cash holdings in real terms, history seems to suggest a better alternative might be to put cash to work for the medium to long term and ride out the financial markets’ volatility.

KLO Financial Services

Our independent financial advisers in Warwickshire, the West Midlands and London can help you understand the importance of personal financial management, including advice on where to invest your money and the objectives of portfolio diversification.

If you’re looking for more support with your finances, why not check out our other services, including independent pension advice and retirement planning, support with business protection insurance and inheritance tax planning or give us a call on 01926 492406!

Disclaimer

Any research is for information purposes only and does not constitute financial advice. The value of investments and any income from them may go down as well as up, so you may get back less than you invested. Past performance cannot be relied upon as a guide to future performance. KLO Financial Services Ltd are registered in the UK, company number 08711328. We are authorised and regulated by the Financial Conduct Authority, reference 710272.

For any information please visit our website klofinancialservices.com