An Investment Portfolio for Mr. Twain

Flipping Correlation

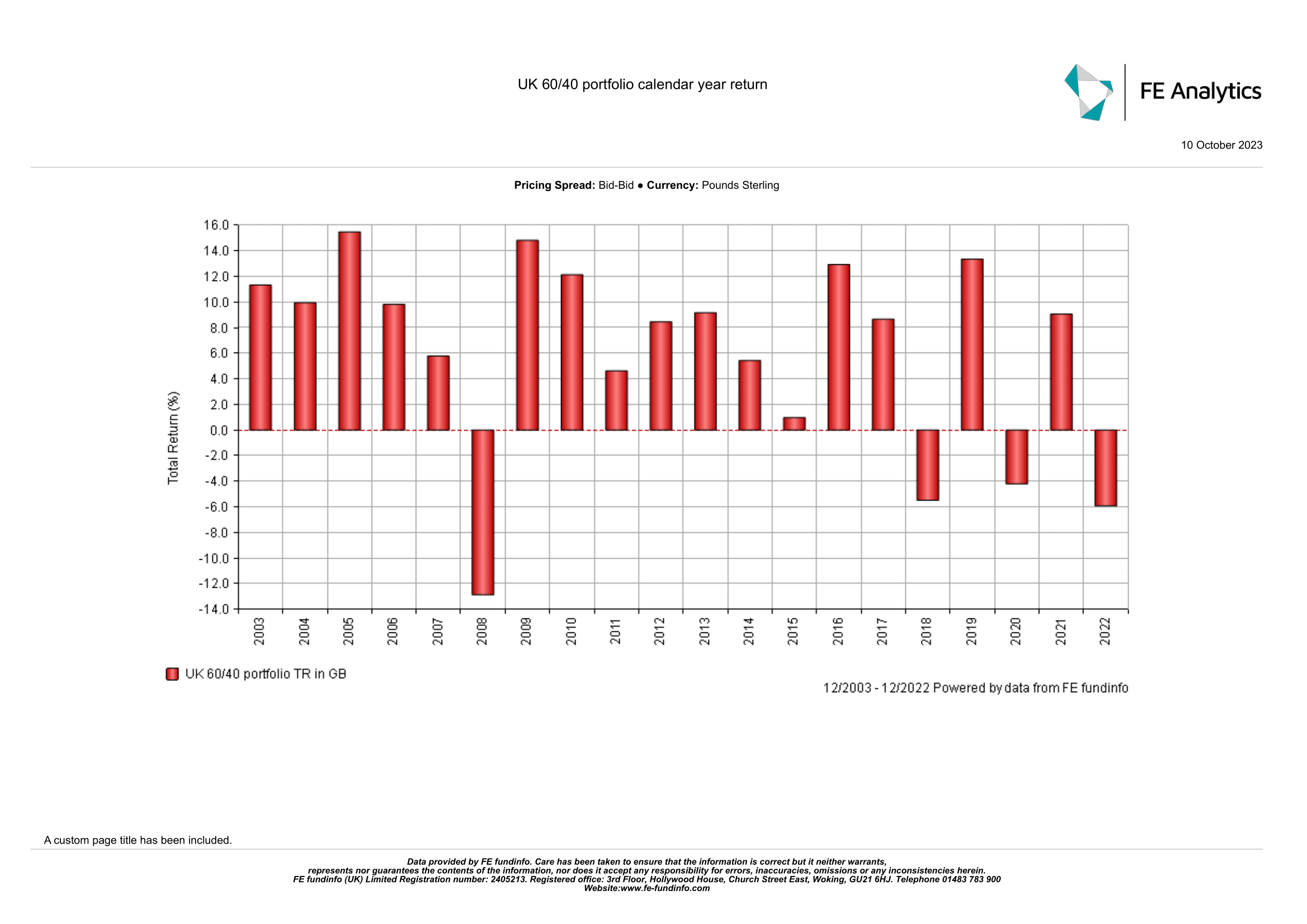

Over the calendar year 2022, a hypothetical balanced portfolio made up of a 60% allocation to UK equity, and a 40% allocation to UK Gilts (UK Government bonds), would have delivered a -6% total return.

This is not the first time a portfolio of this kind would have provided a negative total return in a calendar year. In 2008 at the time of the Global Financial Crisis, in 2018 and again during the global Covid-19 pandemic of 2020, losses would have been registered as well.

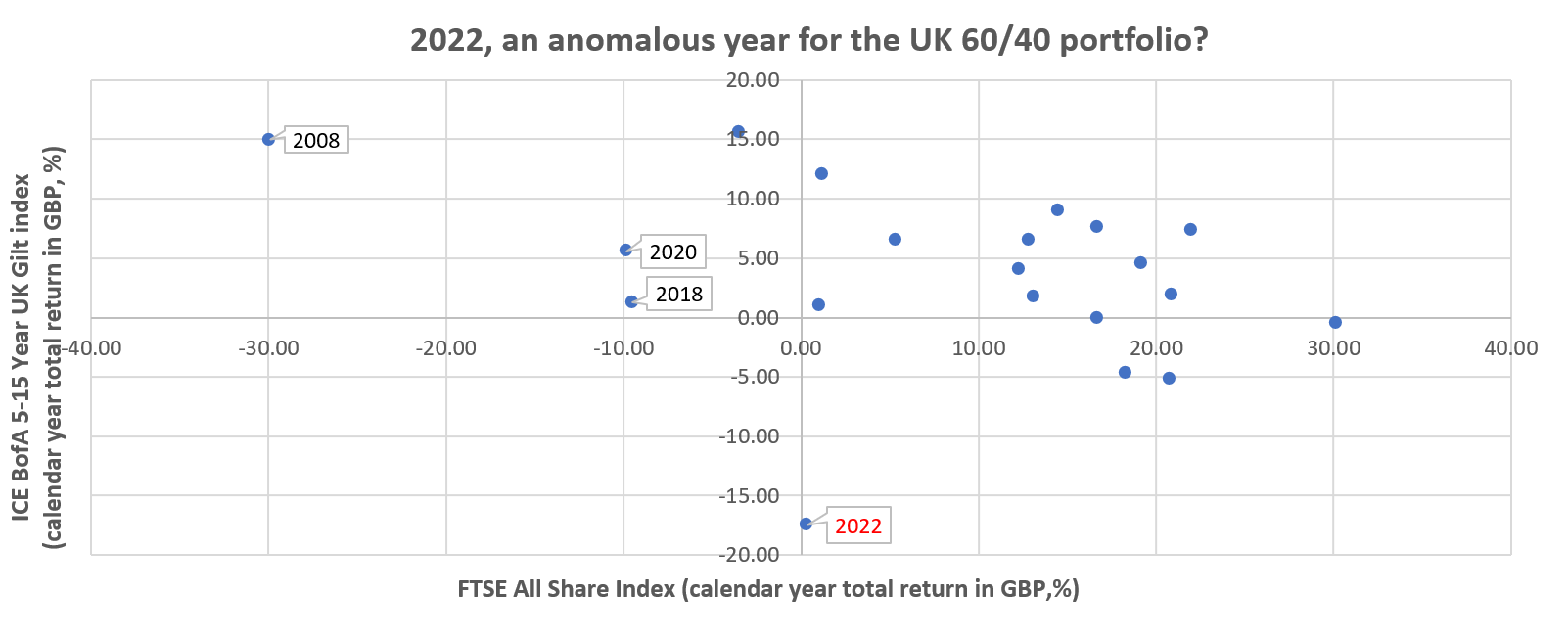

However, as shown in the below chart, what was unusual in 2022 compared to previous episodes, was that the loss on the portfolio would have been due to a combination of Gilts sharply falling in price (yields rising), and UK equities also underperforming at the same time. The two asset classes showing a strong positive correlation, in other words moving in the same direction i.e., down, for the first time in 20 years. By contrast, the rationale of creating a traditional 60/40 portfolio is based on the expectation of a negative correlation between equity and Gilts. This simply means these two asset classes going in opposite direction; bonds doing well when equity struggles and vice versa, thus compensating each other, at least to a certain degree. This is what financial history suggests.

For instance, looking at previous episodes such as 2008 at the time of the Global Financial Crisis, the almost 30% fall in the FTSE All Share index in that calendar year would have been mitigated (to an extent) by the 15% return on the Gilts component of the portfolio. The same negative correlation happened in 2018 and 2020.

It appears 2022 was exceptional in this regard.

What Caused the Correlation to Flip?

By the time the Bank of England embarked on its interest rates hiking cycle in December 2021, the yield on the UK 10-year Gilt was 0.97% and the Bank Rate was 0.25%. By the end of 2022, the yield on the UK 10-year Gilt had skyrocketed to 3.66% (price falling) and the Bank Rate was raised to 3.5% in an effort to fight inflation which had reached historic highs (Consumer Price Index registering a 9% increase in calendar year 2022).

The combination of sharply rising interest rates and inflation at 40 years high was a toxic mix which wreaked havoc in the Gilts markets, with the ICE BofA 5-15 Year UK Gilt index returning -17.5%. Rising interest rates, expected to drastically slow economic growth and probably to tip the economy into recession, also negatively affected the equity market, with the FTSE All Share index barely scraping a 0.34% total return by year end. Hence the sharp underperformance of the combined UK 60/40 portfolio in 2022, with the diversification between equity and fixed interest assets failing to provide any meaningful balance.

Any News?

After 14th consecutive rises in Bank Rate, the Bank of England at its last meeting, held on the 20th of September, reached the decision to finally pause the hiking cycle. This, coupled with inflation starting to moderate, albeit at a slow pace, should be positive news for current and prospective holders of fixed interest assets. Following the recent sustained sell-off in Gilts, the current elevated level of yields (lower prices) now represents a good entry point. UK government bonds should be in a position once again to provide an effective diversification role in a balanced portfolio.

Over the twenty years sample examined, the UK 60/40 portfolio failed to provide a positive nominal total return only on 4 occasions, i.e., it has showed an 80% success rate. Only under the exceptional circumstances of 2022 the fixed interest component of the portfolio failed to cushion, at least to a certain degree, the underperformance of the equity component.

Risks that might negatively weigh on the typical 60/40 portfolio are still lurking, particularly Inflation re-accelerating because of rising oil prices or a tight labour market fuelling strong wage growth, forcing central banks to increase interest rates even further. The jury on the vitality of the traditional balanced portfolio going forward is still out, maybe investors are really witnessing a paradigm shift. Or maybe not, and reports of the death of the balanced 60/40 portfolio have been greatly exaggerated.

Looking for Help With Financial Portfolio Management in Birmingham, London, or Warwick?

We focus on delivering high quality financial advice across a variety of areas.

From personal financial planning to ethical investing or support with the investment process we are here to help.

So, if you are looking for an Investment Account Manager or Financial Planner in Birmingham, Warwick, or London, get in touch today. Call us on 01926 492 406.

Disclaimer

Any research is for information purposes only and does not constitute financial advice. The value of investments and any income from them may go down as well as up, so you may get back less than you invested. Past performance cannot be relied upon as a guide to future performance. KLO Financial Services Ltd are registered in the UK, company number 08711328. We are authorised and regulated by the Financial Conduct Authority, reference 710272. For any information please visit our website www.klofinancialservices.com