Rise to Dump: Is Trump good for the US stock market?

Rise to Dump: Is Trump good for the US stock market?

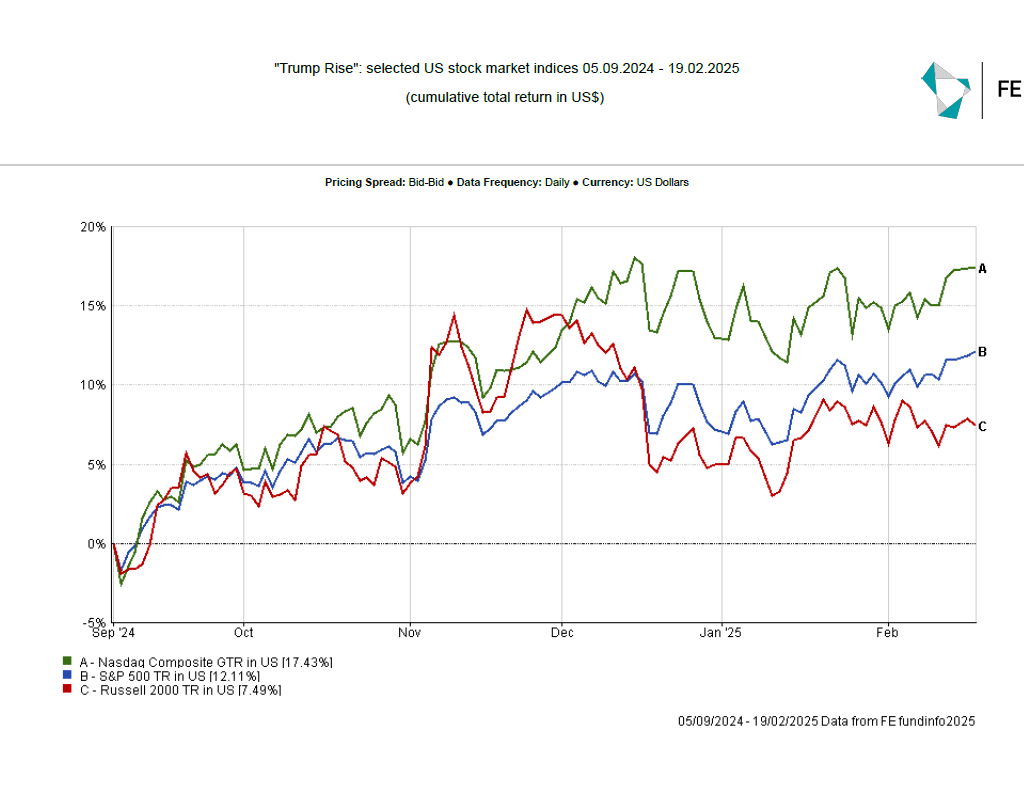

In the couple of months preceding the US presidential election last November, when the probability of presidential candidate Trump being elected kept increasing, and after Trump became the US 47th president, US equity markets surged across the board.

To such an extent that the S&P 500 stock market index of US large companies reached an historic all time high on 19th of February.

The prospect of “Trumponomics” based on an agenda of tax cuts, deregulation, and increase in the productivity of the government sector, buoyed investors’ sentiments:

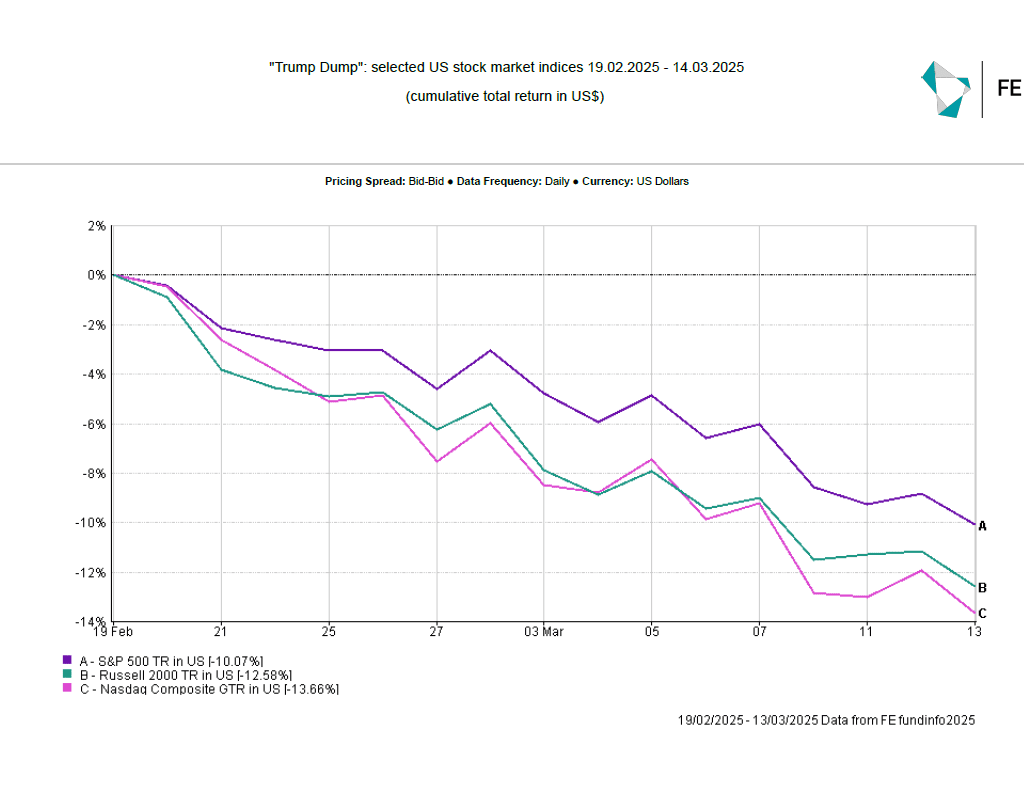

Then, starting in the last week of February, the upward trajectory was completely reversed, and the US equity market fell sharply across the board, suffering what is termed in investment jargon a “correction”, namely, a fall of at least 10% from the most recent peak.

In some segments of the market, the sell-off was even more acute, with a basket of the so called “Magnificent 7” stocks, mostly associated with the Artificial Intelligence (AI) theme, falling in the region of 20% from peak, hence matching the traditional definition of entering “bear market” territory.

What is behind Trump’s impact on US stock market

President Trump’s international trade policies have fuelled concerns about the economic growth and inflation outlook in the US, raising the risk of negative impacts on the economy, if not even of an outright economic recession, and of inflation flaring up again.

Albeit there was some talk on the part of presidential candidate Trump about introducing international tariffs, with the stated aims of raising tax revenues and protect and promote US based sectors of the economy, many investors were caught off guard by the scope and unpredictability of the tariff policies followed by President Trump so far.

This trade policy uncertainty and its possible inflationary and economic growth reducing repercussions, played a role in denting investors’ sentiment.

It is also possible that investors have grown to appreciate the fact that the launch of a low cost and, apparently, energy efficient Chinese AI product, named DeepSeek, has raised the prospect that US companies will have to face a tougher international competitive environment in the Artificial Intelligence arena, compressing their future profit margins.

Rich valuations in the US equity market have also played a role, in two ways: investors, particularly institutional ones, might have decided to book some profit by selling shares which have had such a strong and prolonged rally, and capital flows might have been redirected towards other equity markets such the UK and European ones, where discounted valuations offered the chance of buying the shares of good quality companies at attractive prices.

Short term, market volatility is very likely to persist, as investors reassess the prospects for the US economy, inflation and the internal and international ramifications of the Trump administration’s tariff policies.

However, overall, it appears the recent sell off could be construed as a healthy readjustment towards valuations more aligned with economic fundamentals and companies’ earnings prospect. Inflation is abating and the chances of the US suffering an economic recession are not elevated, they currently stand at about 27% according to the recession forecast model relied on by the Federal Reserve Bank of New York, albeit recent surveys of consumers’ confidence show the latter has fallen sharply.

Financial history suggests that long term is not a good idea to bet against the US equity market, home to the world’s largest, more dynamic and innovative economy; that said, some degree of equity diversification in terms of geographical allocations is always a wise course of action for investors to follow.

Looking for expert advice from a local financial adviser?

At KLO Financial Services, we offer expert personal financial planning, financial portfolio management and investment diversification strategies.

Our team of independent financial advisers keep on top of all the news impacting your money such as the tariffs and stock market, and are here to help you plan and secure the life you want and deserve.

To speak to one of our personal financial advisers in Birmingham and Warwick, call 01926 492406 or email enquiries@klofinancialservices.com

Disclaimer

Any research is for information purposes only and does not constitute financial advice. The value of investments and any income from them may go down as well as up, so you may get back less than you invested. Past performance cannot be relied upon as a guide to future performance. KLO Financial Services Ltd are registered in the UK, company number 08711328. We are authorised and regulated by the Financial Conduct Authority, reference 710272. For any information please visit our website www.klofinancialservices.com