Oil & Gas and ESG?

Contrasting Fortunes for Investments

2022 was a veritable “annus horribilis” for investors in many respects. Among the sectors which suffered the most in terms of failing to deliver positive returns, one can certainly include the vast majority of investments categorised as ESG (Environmental, Social, Governance) and those generally belonging to the Responsible investing category.

In broad terms, stocks featuring ESG characteristics tend to be predominantly, albeit not exclusively, “growth” stocks, i.e., shares of companies inclined not to pay dividends but preferring to retain and reinvest their earnings and expected to grow sales and revenues at a faster rate than the market average, thus providing opportunities for capital appreciation.

In turn, these features make growth stocks (long-duration assets) essentially investments sensitive to movements in interest rates, with a rise in the latter expected to negatively impact these types of stocks.

With inflation at 40 years high, central banks in the UK, the US and Continental Europe had no choice but to start raising interest rates aggressively in 2022, and this interest rates hiking cycle wrought havoc on growth stocks.

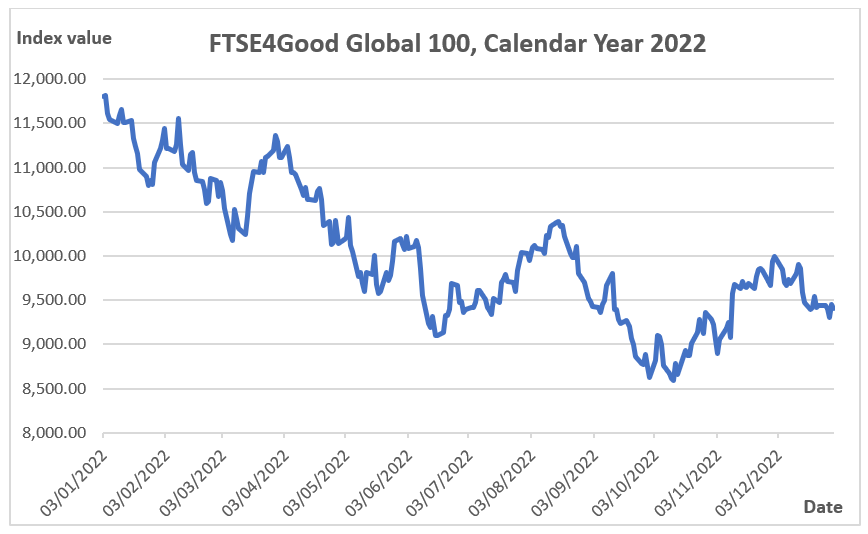

This is exemplified by the performance of the FTSE4Good Global 100 index, which returned almost -20% in the 2022 calendar year.

The index is designed to measure the performance of global companies that have an ESG rating above a specific threshold according to the FTSE Russell ESG scoring methodology , thus providing a good proxy for how the ESG sector fared as a whole during the year:

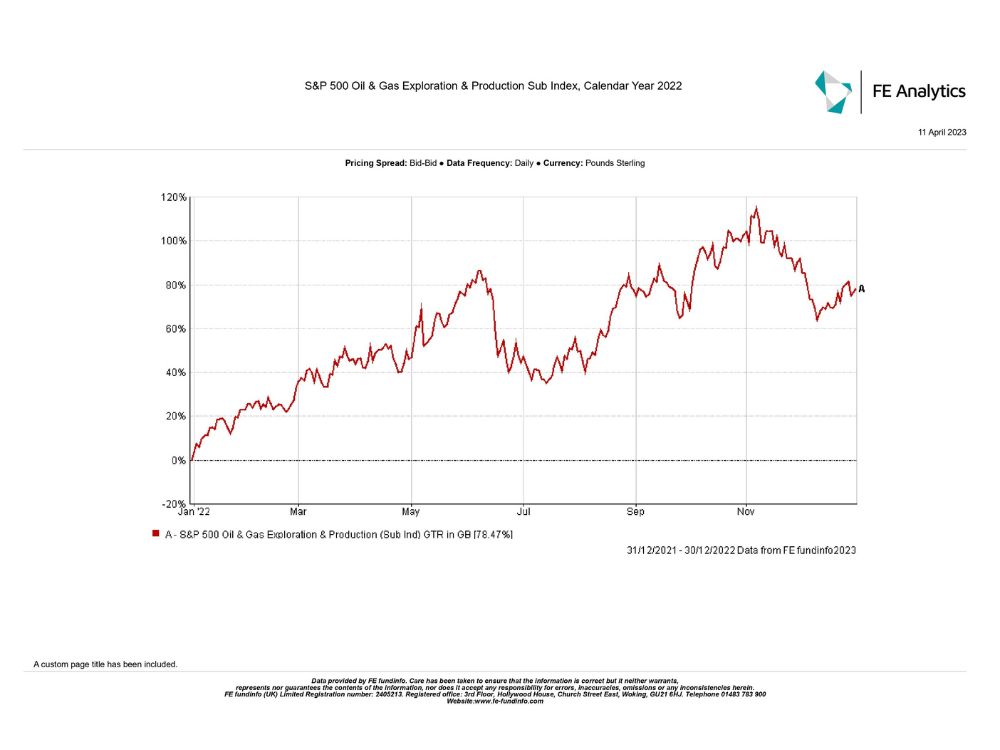

By contrast, in the wake of the gradual re-opening of the global economy after the Covid-19 pandemic and the Russian invasion of Ukraine, the price of energy skyrocketed, propelling the performance of the Oil & Gas sector to dizzying heights, as exemplified by the S&P 500 Oil & Gas Exploration and Production sub-index returning over 78% in GBP in 2022 :

Trend Reversal in 2023?

In the year to date , the picture is the mirror image of what happened in 2022, with the FTSE4Good 100 Global index up almost 10%, whereas the S&P 500 Oil & Gas Exploration and Production sub-index has returned -7% in GBP.

What changed at the turn of the year?

In January and the beginning of February this year, expectations took hold among investors that inflation had finally peaked and, consequently, central banks are nearing the end of their interest rates hiking cycle, and this scenario favoured growth stocks.

At the same time, the lagged effects of central banks increasing interest rates at an unprecedented speed coupled with turmoil in the banking sector in the US culminating in the insolvency of Silicon Valley Bank, raised the risk of a prolonged economic recession with detrimental repercussions on the oil and gas sector, in anticipation of falling demand for energy.

It is probably in this light that one should read the recent move by the Organisation of Petroleum Exporting Countries and Russia (collectively known as OPEC+) to cut production by 1.16 million barrels of oil per day starting in May, to put a floor under the price of oil in case a global economic slowdown, or worse, a global recession, should materialise in the near term.

However, this macroeconomic environment might change again, with recession risks fading, favouring the oil and gas sector, and with inflation remaining “sticky”, forcing central banks to keep interest rates “higher for longer”, a scenario not expected to favour growth stocks.

The “Energy Transition” Towards Net Zero

The United Nations Intergovernmental Panel on Climate Change (IPCC) released its AR6 report in March this year, warning that failure to reduce greenhouse gas emissions will make the aim of keeping the global surface temperature from increasing more than 2.0°C practically unachievable, with predicted catastrophic consequences for the planet.

Therefore, the direction of travel appears to be clear as embodied by many government initiatives directed at accelerating the “energy transition” away from hydrocarbons, such as the Inflation Reduction Act in the US, with its panoply of incentives and subsidies for renewables and electric cars manufacturing, the REPowerEU plan launched by the European Union to increase the production of renewable energy, and the UK government commitment to reaching net zero greenhouse gas emissions by 2050.

In addition, the environmental requirement has now been reinforced by the need for geopolitical security in the wake of the Russian invasion of Ukraine, to prevent hostile countries from weaponizing the use of natural resources and energy in international confrontations.

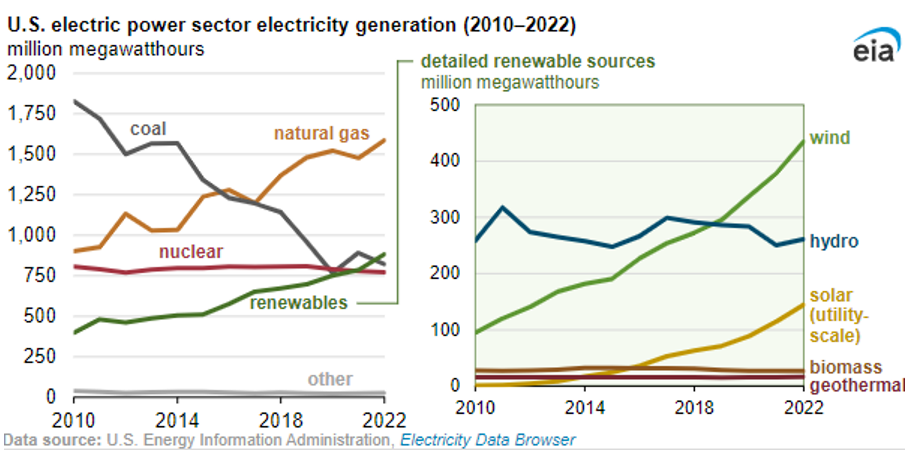

The transition process is well underway and as reported by the US Energy Information Administration (EIA) the renewable generation (wind, solar, hydro, biomass, and geothermal) surpassed coal and nuclear in the US electric power sector electricity generation in 2022:

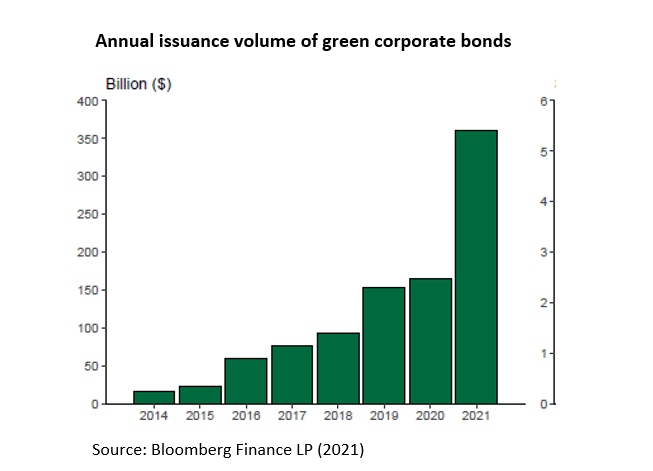

The market has also witnessed a flurry of new issuance of so-called corporate “green bonds” over the last few years, i.e., bonds which contain provisions directing the funds raised from the bonds’ issuance towards environmental projects .

As of 2021, green corporate bonds account for nearly six per cent of global corporate bonds outstanding, up from less than one per cent in 2014 .

The recent popularity of green bonds has even given rise to the phenomenon labelled “Greenium”, i.e., investors ready to pay a premium price for green bonds compared to conventional bonds, thus contributing to lowering companies’ cost of capital.

That said, during transition phases the old and the new paradigms live side by side for an undetermined period and it is realistic to envisage an important role still to be played by oil and gas (and probably nuclear energy too) for years to come.

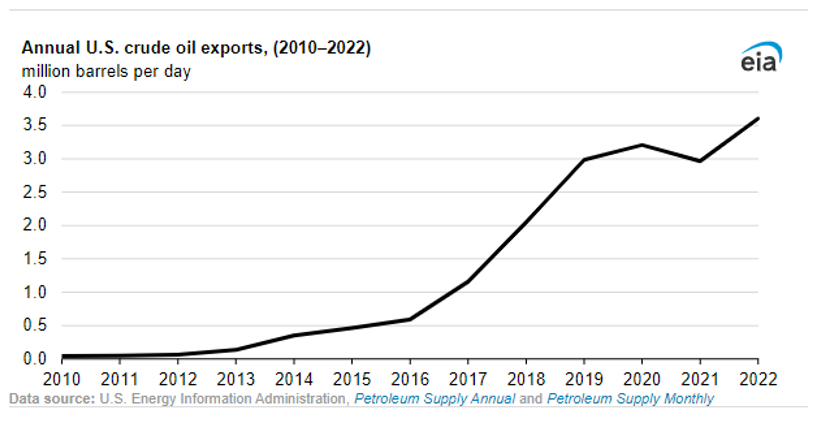

For all the talk of energy transition, the uncertainty of the current phase is well exemplified by record US crude oil exports averaging 3.6 million barrels a day in 2022, with the UK and Continental Europe the main destination markets. In addition, EU sanctions implemented in December 2022 that prohibit all seaborne imports of Russia’s oil to Europe make it likely that demand for U.S. crude oil will remain strong in 2023:

For investors, this transition phase is challenging, not easy to navigate in terms of investment choices and to a certain extent confusing too. Philosopher of science Thomas Kuhn highlighted that it is ‘as if the professional community had been suddenly transported to another planet where familiar objects are seen in a different light and are joined by unfamiliar ones as well’.

Expert Financial Services in Birmingham, Warwick and London

At KLO Financial Services we focus on providing our clients with tailored financial solutions across a variety of areas including investment planning, personal finances, and tax planning.

So, if you are looking to speak to a local financial adviser in Birmingham, London or Warwick then get in touch with us today. Call us on 01926 492406!

Disclaimer

Any research is for information purposes only and does not constitute financial advice. The value of investments and any income from them may go down as well as up, so you may get back less than you invested. Past performance cannot be relied upon as a guide to future performance. KLO Financial Services Ltd are registered in the UK, company number 08711328. We are authorised and regulated by the Financial Conduct Authority, reference 710272. For any information please visit our website www.klofinancialservices.com