Pension Charging and Retirement Planning Services

Blissful Ignorance?

Contrary to English poet Thomas Gray’s assertion that “ignorance is bliss” in his 1742 poem “Ode on a Distant Prospect of Eton College,” when it comes to pension arrangements, knowledge of the details can make an important financial difference.

Still, according to a survey of 2,000 British adults conducted by MoneyFarm, half of the respondents were apparently unaware that they were paying fees on their pension schemes.

Probably even worse, about half of those surveyed who knew they were paying charges did not know the amount of fees they were billed.

Pension Charges Over Your Lifetime

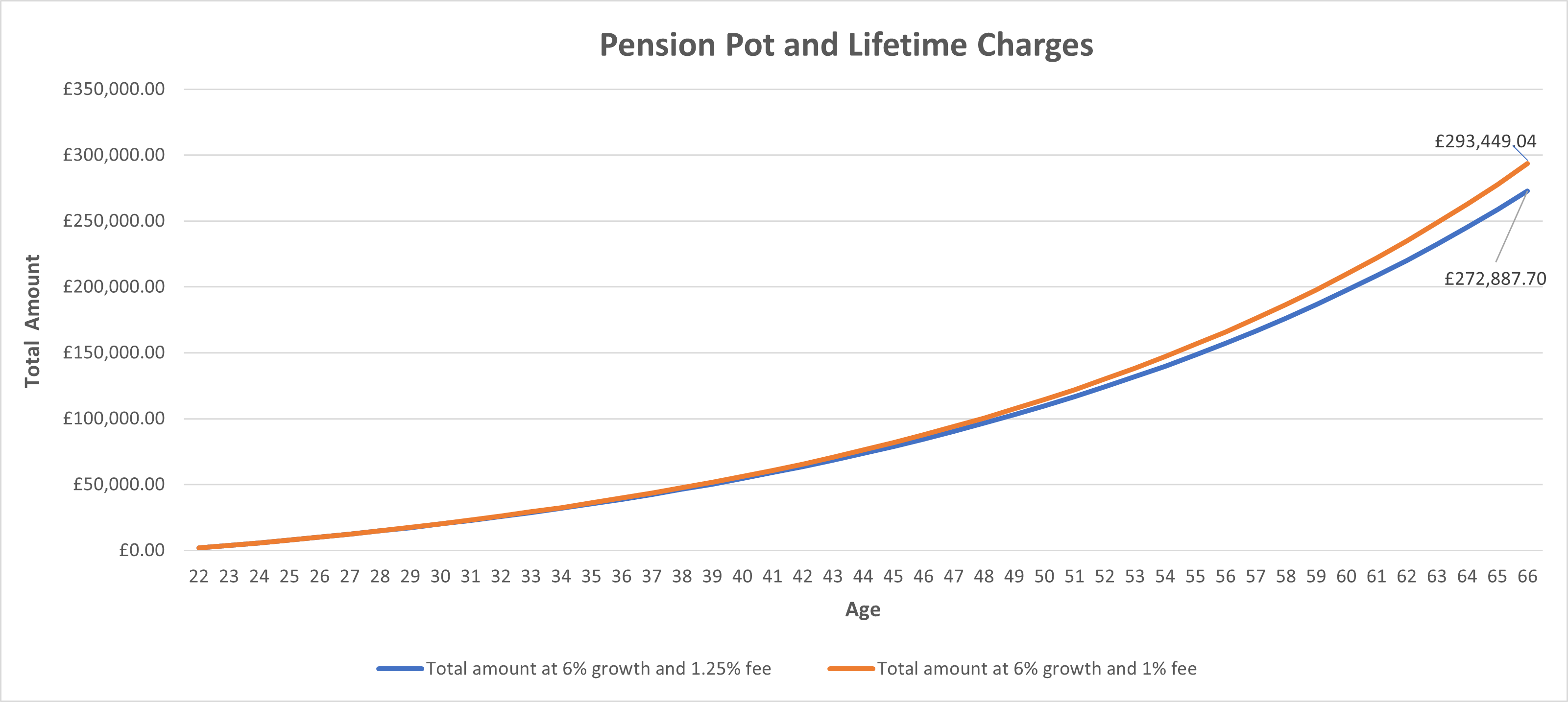

To visualise the importance of costs over a long period, the below graph displays a pension pot for an individual earning the UK median salary of £35,000 from the age of 22. Here, they save 5% of it each year for the rest of their working life whilst accruing a gross 6% annual return on the invested pension pot under two scenarios:

1) with a 1.25% annual charge.

2) with a 1% annual charge.

Author’s calculations, 5% of annual salary added at the beginning of each year to the previous balance, source for the UK median wage is The Office for National Statistics

At age 66, the individual saving an apparently modest 0.25% in annual charges has built up an extra £20,561.34 in the personal pension pot.

A small difference in fees and, thanks to the power on compounding returns over time, a substantially different financial outcome between the two scenarios. It is “folly to be wise” according to the poet’s sentiment, however, when it comes to planning for retirement, knowledge is essential.

Work With Local Pension Advisors to Avoid This Situation

Retirement planning services from dedicated financial advisors can help you save on additional payments, including management fees or pensions savings tax charges, to help you get the most out of the money you’ve worked hard to save.

As you can see, even the smallest charge can make a huge difference when it’s time to claim your pension, so working with a professional is crucial in maximising available funds.

Our specialist advisors, providing dedicated financial services in Birmingham, London, and Warwick, can help you and your family achieve your financial goals and maximise your pension savings.

Get in touch today by calling our head office on 01926 492 406 or emailing enquiries@klofinancialservices.com and one of our financial specialists will help talk you through everything you need to know.

Disclaimer

Any research is for information purposes only and does not constitute financial advice. The value of investments and any income from them may go down as well as up, so you may get back less than you invested. Past performance cannot be relied upon as a guide to future performance. KLO Financial Services Ltd are registered in the UK, company number 08711328. We are authorised and regulated by the Financial Conduct Authority, reference 710272. For any information please visit our website www.klofinancialservices.com