Rising Interest Rates and the Impact on the Tech Sector and Growth Stocks

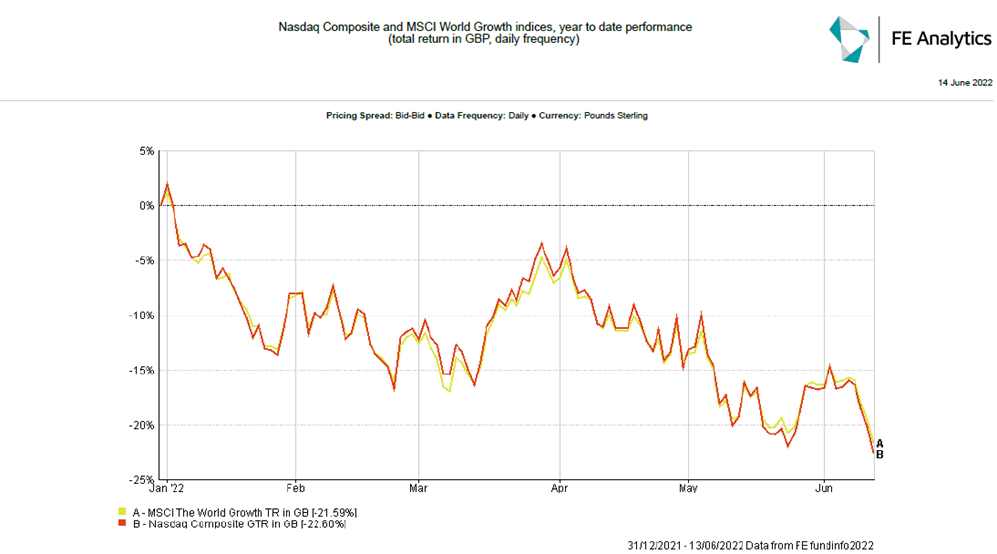

The technology sector and the growth stocks generally, as proxied, for instance, by the Nasdaq Composite Index in the US and the MSCI World Growth Index, have officially entered bear market territory, by losing more than 20% in GBP terms from the start of 2022:

The routine, typical explanation for the fall in value is that tech/communication services and generally, all growth stocks are “long duration” assets, thus being negatively affected by rising interest rates.

With inflation at 40 years high in the US and the UK and both the Bank of England and the US Federal Reserve Bank committed to tame inflationary forces by raising policy interest rates, the overall economic background remains very challenging for the tech sector and growth stocks.

Could it get even worse?

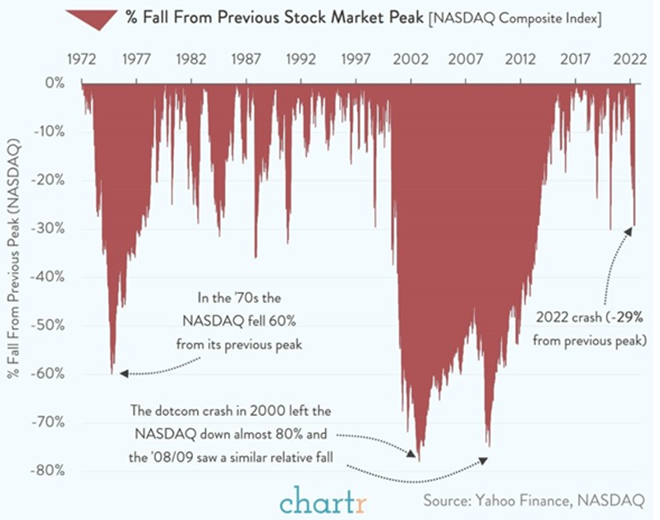

Judging from past episodes of market action, it would be easy to lose sleep about the risk of the market falling even further. Crushing, actually.

As evidenced by the below graph, the Nasdaq Composite Index fell by almost 80% from its peak during both the bursting of the dotcom bubble in the early 2000s and at the height of the Global Financial Crisis in 2008-09:

For the prophets of technological doom, high inflation/rising interest rates are not the only strong headwinds facing tech stocks. The latter will also be negatively affected by the draining of liquidity in financial markets once central banks in the US and the UK (and eventually, maybe, also on the European Continent) will start implementing their Quantitative Tightening policies in earnest.

The argument goes that tech stocks profited by the “stay at home” regime caused by the Covid-19 pandemic and by the subsequent sea of liquidity released in financial markets by central banks via Quantitative Easing policies.

According to the tech sceptics’ thesis, the combination of the lockdowns and loose monetary policy pushed these kinds of stocks dangerously close to, or even into, bubble territory.

These strong tailwinds have now faded or are about to go into reverse.

However, the comparison with the performance of tech stocks in the early 2000s might not be accurate, as at the time many companies were highly speculative, profitless, and not cash generative. The tech mania reached such a level of absurdity that the value of some companies was estimated by the number of “eyeballs” visiting the companies’ websites, with no customers or even products and services to show for it! This had echoes of the South Sea Bubble when allegedly a financial planning promotion appeared in newspapers trying to allure investors to put money into “a company for carrying on an undertaking of great advantage, but nobody to know what it is”.

A far cry from today’s companies, most of them involved at the cutting edge of applied technological research, providing great services, and products and, at least some of them, enjoying relatively stable profit margins and a degree of market power.

As for the Global Financial Crisis in 2008-09, the entire Western financial planning systems was on the brink of annihilation, there was nothing specifically wrong with the tech sector per se, it was probably just at the receiving end of magnified downside volatility in financial markets.

What’s the outlook for tech & growth stocks?

Perhaps, one really is witnessing the initial stages of a bubble bursting.

After all, episodes of stock market bubbles are clearly identified only in retrospect, as recognised by Sir Isaac Newton when he himself was enmeshed in the South Sea Bubble, lamenting that he could “calculate the motions of the heavenly bodies, but not the madness of people”.

There is no doubt that historically high inflation, rising interest rates and the onset of Quantitative Tightening policies are strong negative factors affecting tech and growth stocks. This uncertain and unfavourable outlook is compounded by the risk of early economic recessions in the US, the UK, and Continental Europe.

However, sometimes it is easy to overlook the extent to which tech already shapes and, in the future, will shape, even more, all aspects of our daily lives and society – from healthcare to financial services, from entertainment and transportation to robotics and artificial intelligence, to name just a few obvious areas of application.

Besides, technological innovation will play a decisive role in the transition to a net zero, carbon neutral, world. Planet Earth demands it, and in the wake of the Russian invasion of Ukraine geopolitical security demands it as well.

Structural change and the Schumpeterian “gale of creative destruction” are at the heart of the innovation process. These are long-term forces that will not disappear anytime soon.

The volatility, at times even extreme, will remain, it is intrinsic to these kinds of stocks. Maybe, one runs the risk of jumping into the treacherous waves of the South Sea and being submerged by them.

However, it is equally likely current market conditions offer an opportunity to buy great established companies as well as more adventurous ones at what seems to be good prices, provided one is ready to ride the volatility, hold the nerves, and remain invested for the long term.

KLO Financial Services

We are independent financial advisers offering services from personal financial planning to supporting you with your investment portfolio.

With the expertise of our in-house Investment Analyst, we are well equipped to help you navigate your investments in this high-interest and inflating market. We can even help you take a long-term approach, invest more responsibly and ensure your investments are futureproofed through portfolio diversification.

Want to find out more? Speak to one of our experts on 01926 492406!