The “Santa Claus Rally” Story

In financial markets there is a well-established thinking according to which the month of December, particularly in the week leading up to the Christmas holiday, is positive for stock markets in terms of generating good returns.

This effect is traditionally dubbed the “Santa Claus Rally”.

What Causes this Stock Effect to Occur?

Many explanations have been given for this phenomenon, not necessarily mutually exclusive. These range from holiday spending on presents and vacations boosting companies’ earnings, to positive investors sentiment thanks to the festive mood, thought to affect mostly small, retail investors.

As well as, investment managers “dressing up” their portfolios at year end by adding to stock holdings which have performed well, thus further enhancing their prices.

There might be a grain of truth in the above explanations. It is more likely investors tell each other stories in order to reassure themselves some kind of pattern can be discerned in the unpredictable, random world of financial markets.

Positive Stock Market Performance

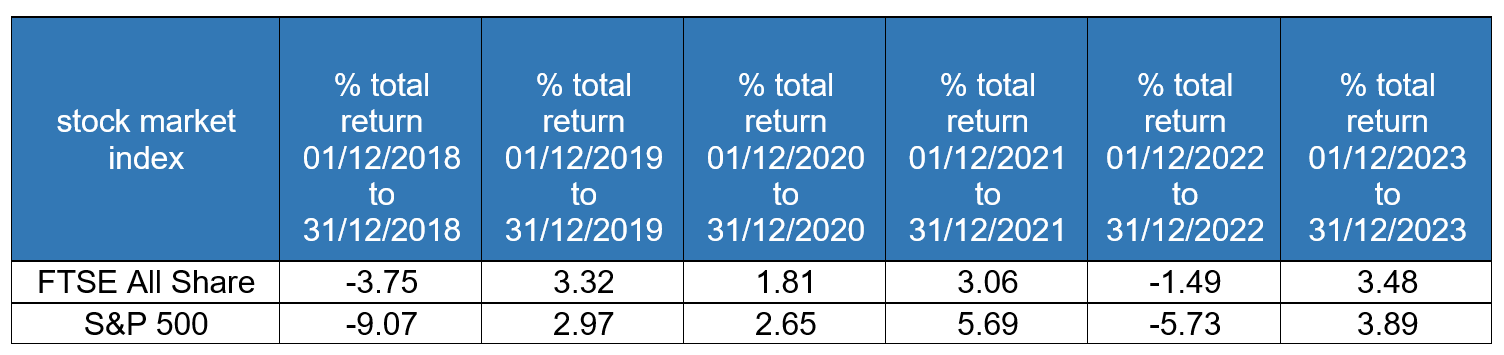

Returns on the US and UK stock markets have been indeed very good last December, with the US S&P 500 index returning 3.89% (in US dollars), and in the UK the FTSE All Share index posting a 3.48% total return.

What fuelled this solid stock market performance?

For all the nice stories we love to believe in, the explanation for last December “Santa Claus rally” is probably far more mundane.

Stock markets were likely lifted by investors’ expectations interest rates that have finally peaked, coupled with abating inflation steadily returning to the 2% inflation target set by major central banks, and by the prospect of the latter soon embarking on an interest rates easing cycles, relieving the pressure of high interest rates on households and businesses alike.

However, even a cursory look at previous instances of returns in the month of December over just the last 5 years shows that the “Santa Clause rally” is far from being an established fact.

To wit, both the UK and the US stock markets, the latter, suffered falls during the month of December in 2018 and 2022:

As the saying goes, “It’s all fun and games until Santa checks the naughty list.”

The only real lesson these financial history data seem to suggest is that stock market volatility is inevitable, a fact of life.

Rallies in Financial Markets can be Sudden and Sharp

Hence, it is important to remain invested to take advantage of a stock market surge like the one that materialised last December (as well as last November), missing these market moves by trying instead to time the market can have a big negative impact on long-term investment returns.

Talk to a Financial Adviser in Birmingham or Warwick

Our priority at KLO is to provide our clients with expert financial advice and support across a variety of areas. We have investment analysts ready to help you, who can work towards your investment philosophy and advise on areas such as ethical stocks to invest in.

We will work diligently to support you through the investment process. Our offices are based in Birmingham, Warwick, and London, so get in touch today by calling 01926 492 406 to find out how we can help you.

Disclaimer

Any research is for information purposes only and does not constitute financial advice. The value of investments and any income from them may go down as well as up, so you may get back less than you invested. Past performance cannot be relied upon as a guide to future performance. KLO Financial Services Ltd are registered in the UK, company number 08711328. We are authorised and regulated by the Financial Conduct Authority, reference 710272. For any information please visit our website www.klofinancialservices.com