The UK Stock Market and Horse Racing

Sell in May?

Archaeological records show that horse racing probably dates as far back as the 16 century BC in Babylon, popular with the Mesopotamian kings.

According to the traditional account, horse racing with raiders took hold in the UK during the Middle Ages, after medieval knights returning from the Crusades brought back fast Arabian and Barb stallions. Since then, horse racing has been one of the favourite leisurely activities of the aristocrats and royalty of British society, earning it the title “Sport of Kings”.

The advent of the Industrial Revolution with its concomitant age of steam, railways, mass transportation and a generally rising standard of living, enabled more and more segments of the population to “go racing”, thus eventually opening up the “Sport of Kings” to everybody.

These developments in turn, since the second half of 19th century, are thought to have affected the UK stock market in a curious way.

The story goes that, apparently, during the summer, stockbrokers and financiers working in the City of London would be too distracted by a combination of holiday taking and attending horse races to focus too much on work, contributing to flat market activity, hence the quintessentially British adage “Sell in May and go away, don’t come back till St. Leger day”, with St. Leger day referring to the last horse race on the English racing calendar falling in mid-September.

Does this seasonal pattern of weak UK markets in the summer still apply in modern times?

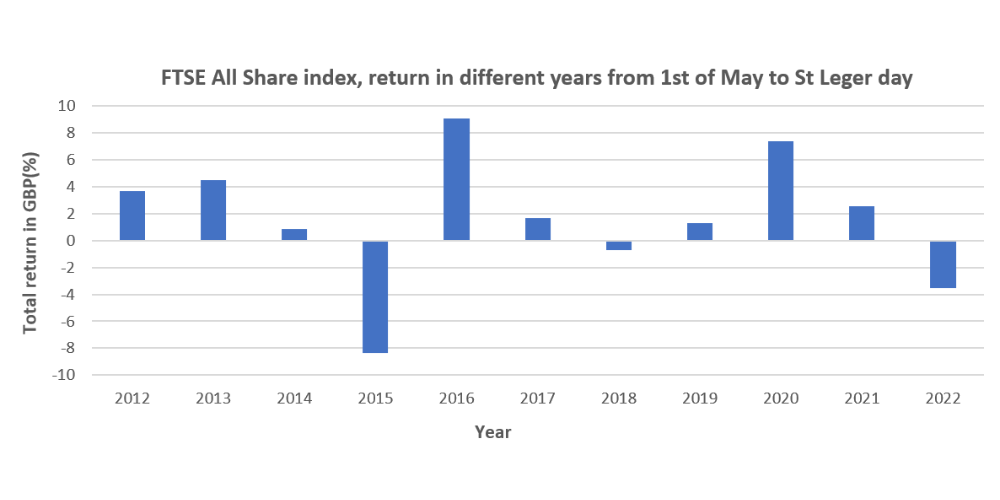

An examination of total returns of the FTSE All Shares index between 1st of May and St. Leger day in the last 10 years shows an average return of 1.7%, with only one year, namely 2015, when severe losses were incurred by investors between 1st of May and St. Leger day (-8.3% index total return).

And even this negative episode was followed by a strong market performance in 2016, with the FTSE All Shares index returning 9% in that year between 1st of May and St. Leger day.

What's Next for the UK Stock Market?

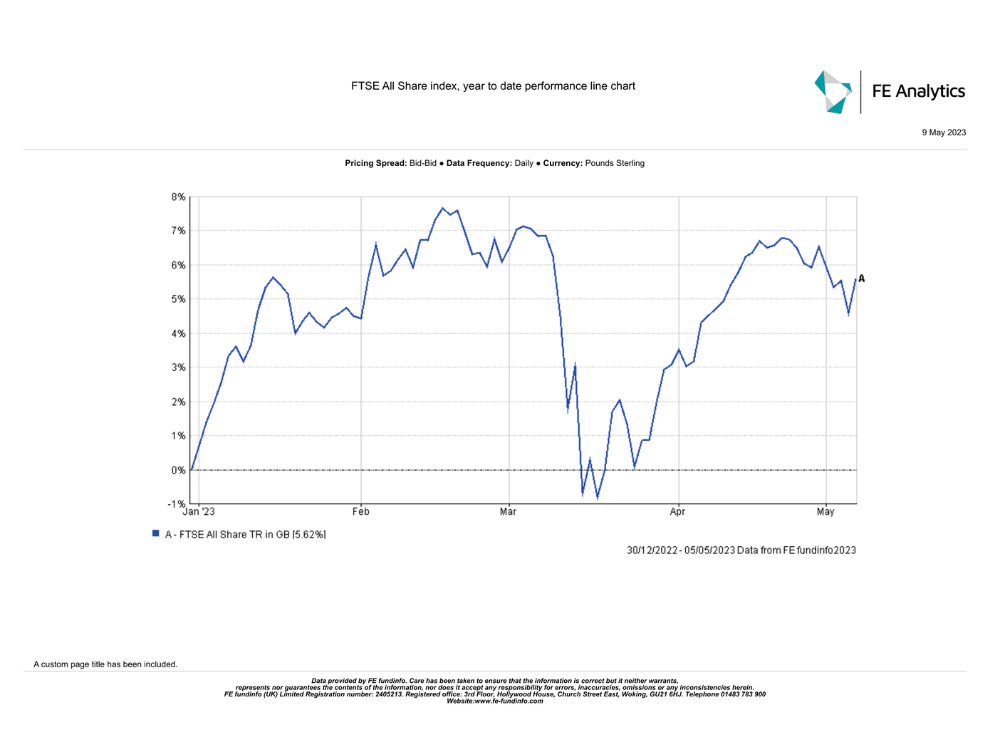

In the wake of the turmoil in the US regional banking sector triggered by the insolvency of Silicon Valley Bank, uncertainty spread across the Pond and the risk of financial contagion caused the FTSE 250 sub-index of financial stocks to fall by 5.5% in March this year.

However, year to date, the FTSE All share index has posted a solid total return of over 5%, even though it suffered a 3% fall in the month of March alone .

If the market can sustain the momentum developed since the start of the year is very difficult to tell.

There is still much uncertainty as regards the health of the economy going into year end and the beginning of 2024.

Previous forecasts of a deep and prolonged economic recession by the Bank of England seem to have been replaced by expectations of a moderate, shallow one, mostly thanks to a still expanding servicer sector and a resilient labour market. The latter, however, is a lagging economic indicator and the cumulative effect on the economy of the interest rate hiking cycle implemented by the Bank of England is likely to operate with some time lags.

Higher interest and mortgage rates, with an estimated 1.4 million homeowners having their fixed interest rates mortgages set to expire by year end, will have a negative effect both on the profitability of businesses by increasing their cost of debt and on households’ disposable income.

This at the same time households’ purchasing power is under severe pressure because of the rising cost of living and businesses have to face high costs of energy and materials.

These have all been ongoing headwinds, particularly for domestically orientated companies generating the bulk of their earnings in the UK, mostly listed on the FTSE 250 and the FTSE Small Cap indices.

The strength of sterling vs. the US dollar is also another factor to consider, given approximately 2/3 of earnings of companies listed on the FTSE 100 are booked in foreign currency, mostly US dollars and Euros.

From the depths reached in the wake of the “mini budget” last year when 1 pound almost fell to parity with the greenback (1£ = 1.03 US$), the pound can now buy you 1.26 US dollars, a currency appreciation of more than 22%. It is possible that any further strengthening of sterling, albeit a positive in terms of reducing the cost of imports, could turn to be a headwind for many companies operating internationally as well as for export-oriented companies.

In addition, a pound too strong could deter the flow of international capital into the UK, thus reducing Mergers & Acquisitions activities.

A recession deeper than expected, should one materialise, will very likely have a negative effect on cyclical sectors such as industrials as well as on the oil & gas, basic materials, and extractive resources sectors, all prominent on the FTSE 100 index.

However, overall, from an international valuation comparison viewpoint, the UK stock market appears to be at a discount. For instance, the MSCI UK index 12-month forward price/earnings ratio is significantly lower compared to the one for the MSCI World index.

Even with respect to its own internal valuation metrics, both the FTSE 100 and the FTE 250 indices appear to be somewhat undervalued, with their 12-month forward price/earnings ratios by April end being below their respective average 12- month forward price/earnings ratios over 1998-2023.

That said, albeit the 12-month forward price/earnings ratio is a useful valuation metric, it is far from being an accurate tool that can be used to “time the market”.

The macroeconomic background remains challenging both at the national and international level, hence the importance of a well-diversified portfolio to try and mitigate the risk of equity investing via diversification.

Tailored financial services in Birmingham, London and Warwick

Our priority at KLO is to provide our clients with expert financial advice and support across a variety of areas. We have personal financial advisers ready to help you, as well as investment analysts who specialise in portfolio diversification and investment diversification.

So, if you are looking to speak to an expert, contact our financial advisers in Birmingham, Warwick, or London today. Call us on 01926 492406.

Disclaimer

Any research is for information purposes only and does not constitute financial advice. The value of investments and any income from them may go down as well as up, so you may get back less than you invested. Past performance cannot be relied upon as a guide to future performance. KLO Financial Services Ltd are registered in the UK, company number 08711328. We are authorised and regulated by the Financial Conduct Authority, reference 710272. For any information please visit our website www.klofinancialservices.com