A Summer scare leading to stock market drops

A heart stopping stock market drop

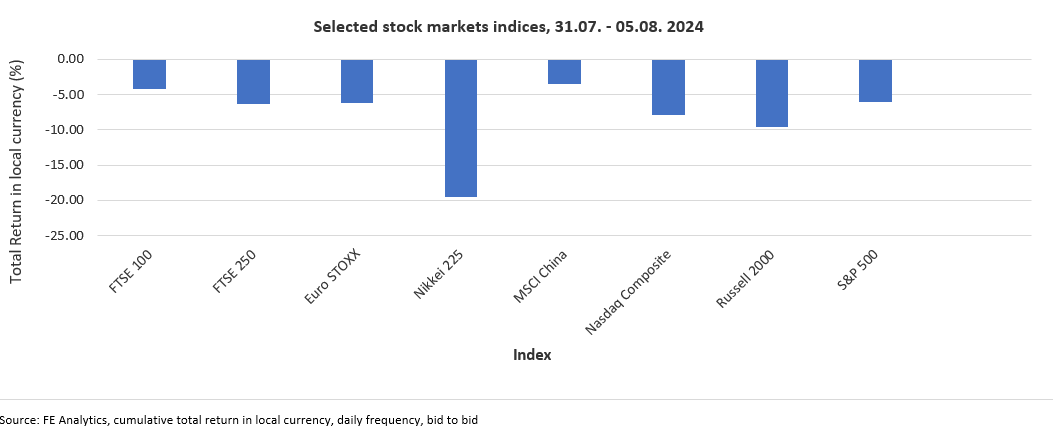

Between the very last day of July and the first few days in August, a stock market drop occurred worldwide, there was no safe space in the equity world from Tokyo and Beijing to New York, passing through London and the Eurozone:

Why is the stock market dropping?

Typically, a combination of causes seems to have contributed to the worldwide synchronous stock market drop.

On the 5th of August, the Japanese stock market index Nikkei 225 fell almost 20%, the largest loss since Black Monday in October 1987.

This was in the wake of the Bank of Japan increasing interest rates from long-held historic lows. The interest rates rise caused the value of the Yen, the Japanese currency, to strengthen, and this in turn had two knock-on effects on markets.

First, it provided a headwind for Japanese companies’ export competitiveness and, secondly, and probably even more importantly, caused the unwinding of the trading strategy known in market jargon as the “Yen carry trade”.

The latter simply refers to the strategy of borrowing in a low interest rates currency, in this case the Japanese Yen before the interest rates move by the Bank of Japan, and using the funds thus raised to buy other higher yielding assets such as higher interest rates currencies or shares and bonds somewhere else around the world.

The increase in interest rates implemented by the Bank of Japan disrupted this strategy as the strengthening of the Yen caused the costs of the carry trade to rise and made it unprofitable in the main. Traders, now forced to repay their borrowings at higher costs, liquidated in huge volume their holdings to raise the required proceeds. This, in turn, triggered an initial widespread selloff around the world.

In addition, investors’ sentiment in the US was adversely affected by the knowledge that legendary investor Warren Buffet had sold 50% of his shareholdings in the US tech company Apple. Given the respect commanded by Mr. Buffet in the investment community, his action was interpreted by many investors as a sign the market top had been reached in the US large cap segment of technology stocks and started unloading shares of big American corporations.

The Artificial Intelligence (AI) story that has propelled the shares of technology, platform and communication services large companies to all-time highs came to be doubted by investors for the very first time. Is AI all that is cracked up to be in terms of delivering a “productivity miracle”?

Then, to further compound the negative picture, recently released rising unemployment figures in the US seeded the doubt in investors’ mind that the US Federal Reserve (the “Fed”) might have incurred in a “policy mistake” in terms of having delayed interest rates cuts for too long, thus causing a “growth scare”.

The latter was reinforced by rising unemployment figures in the US triggering the technical recession indicator known as the “Sahm rule”.

Consequently, the shares of US small and medium sized companies were also offloaded by investors alongside the shares of large companies.

As the saying goes, “when the US sneezes, the rest of the world catches a cold”, and investors’ anxiety spread over other stock markets in the UK, Europe and Asia, in a self-reinforcing vicious spiral.

Where does the stock market go from here?

By the end of the month, markets stabilised after a strong rebound on the 6th of August, and they have now more than fully recouped the initial heavy losses, at least in local currency terms, with the partial exception of the FTSE 250 index in the UK, down by 1.3% over the month.

For all the sudden negative surge in investors ’sentiment in the US, payrolls are still increasing, the UK and the Eurozone economies are both out of technical recessions and broadly on the mend and expanding, albeit admittedly at modest rates.

As far as the US is concerned, the sell-off appears to be more of a healthy correction for markets which had reached hefty valuations, particularly in the technology sector, possibly triggered also by profit taking on the part of big institutional investors.

As for the rest of the world, apart from China and Japan where more idiosyncratic reasons might be at work, the sell-off appears to have been mostly a knock-on effect from the fall of the US market more than having been driven by internal, fundamental causes.

The Bank of England and the European Central Bank have started reducing interest rates, soon to be followed by the US Federal Reserve (the “Fed”) probably at their next meeting in September, all moves which should help to stabilise and sustain markets at least in the short to medium term.

The lesson learnt is that, as it is often the case, some degree of investment diversification, according to one’s risk appetite, across geographies, asset classes, large and small companies, as well as riding the inevitable market volatility, is probably the best course of action for investors to follow.

Looking for expert advice from a local financial adviser?

As leading IFA in Birmingham, London and Warwick, our priority at KLO Financial Services is to provide our clients with expert financial advice and support across a variety of areas. We have local financial advisers ready to help you, as well as investment analysts who specialise in portfolio diversification and investment diversification.

So, if you are looking to speak to an expert financial planner in London, Birmingham or Warwick. Call us on 01926 492406.

Disclaimer

Any research is for information purposes only and does not constitute financial advice. The value of investments and any income from them may go down as well as up, so you may get back less than you invested. Past performance cannot be relied upon as a guide to future performance. KLO Financial Services Ltd are registered in the UK, company number 08711328. We are authorised and regulated by the Financial Conduct Authority, reference 710272. For any information please visit our website www.klofinancialservices.com