Taking Stock, A Market Update

After the shock suffered by financial markets in the first quarter of 2020 due to the outbreak of Covid-19 and the subsequent grinding to a halt of economies worldwide due to the implementation of extensive lockdown measures on the part of Governments worldwide, markets have rebounded strongly in April.

The reason for the rebound has mostly to do with two factors:

- The support to financial markets and the real economy (households and businesses) provided by the stimulus measures implemented by Governments all over the world, in terms of expansionary fiscal and monetary policies (deficit spending, Quantitative Easing, interest rates cuts and targeted support to specific markets such as Asset backed securities and Commercial Paper, Investment Grade and High Yield debt, especially in the US).

- Increasing hopes that lockdown measures could be eased soon, and the economy start to recover.

UK equities rebounded in April, with the FTSE All-Share and the FTSE 100 indexes up 9% and 8% respectively¹.

Japanese equities gained on the back of stimulus measure adopted by the Bank of Japan and Eurozone equities also advanced as some countries began to plan an imminent reopening of some sectors of the economy. The US shares in particular performed quite spectacularly with the S&P 500 Index recording its strongest rally in 30 years (total return of 17.99% in USD²), with healthcare and information technology top-performing sectors.

How did the KLO Growth Model portfolios V8 performed during these extraordinary times?

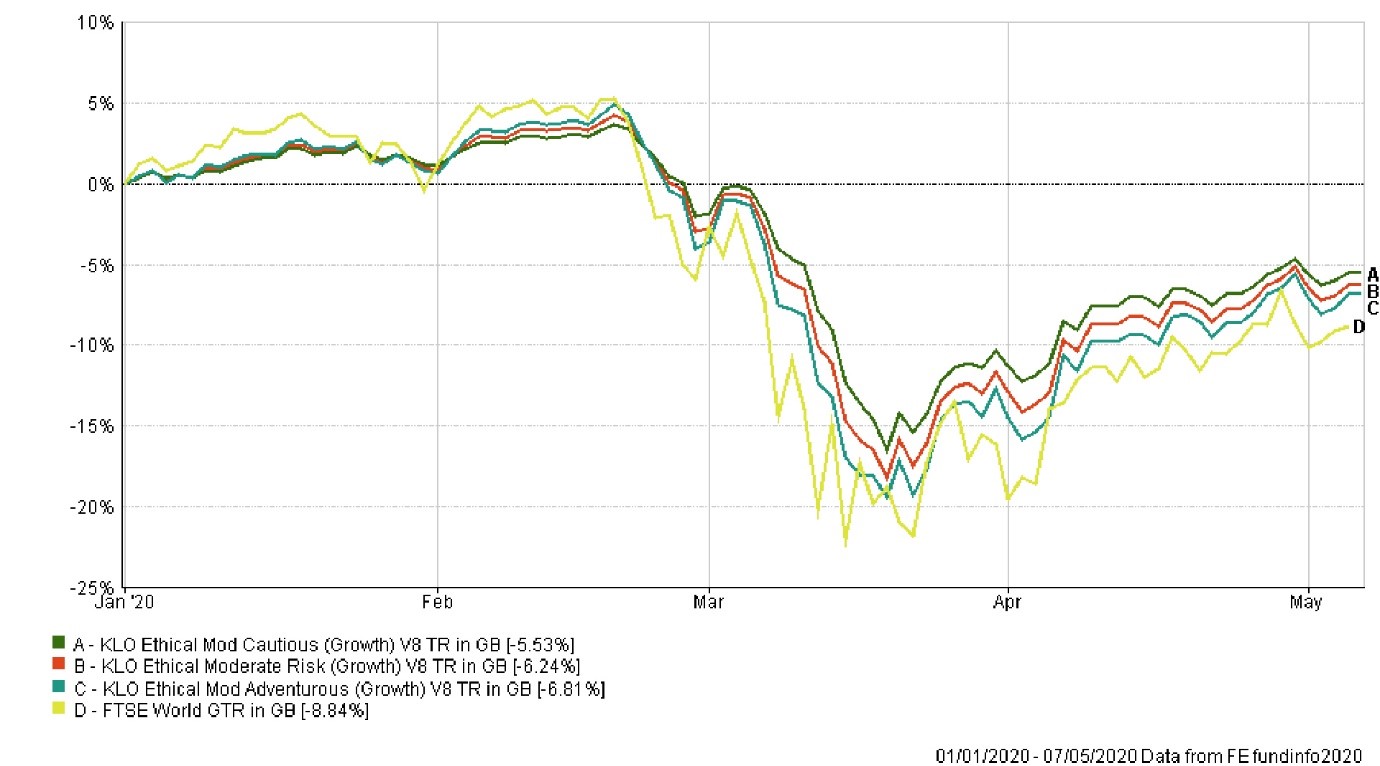

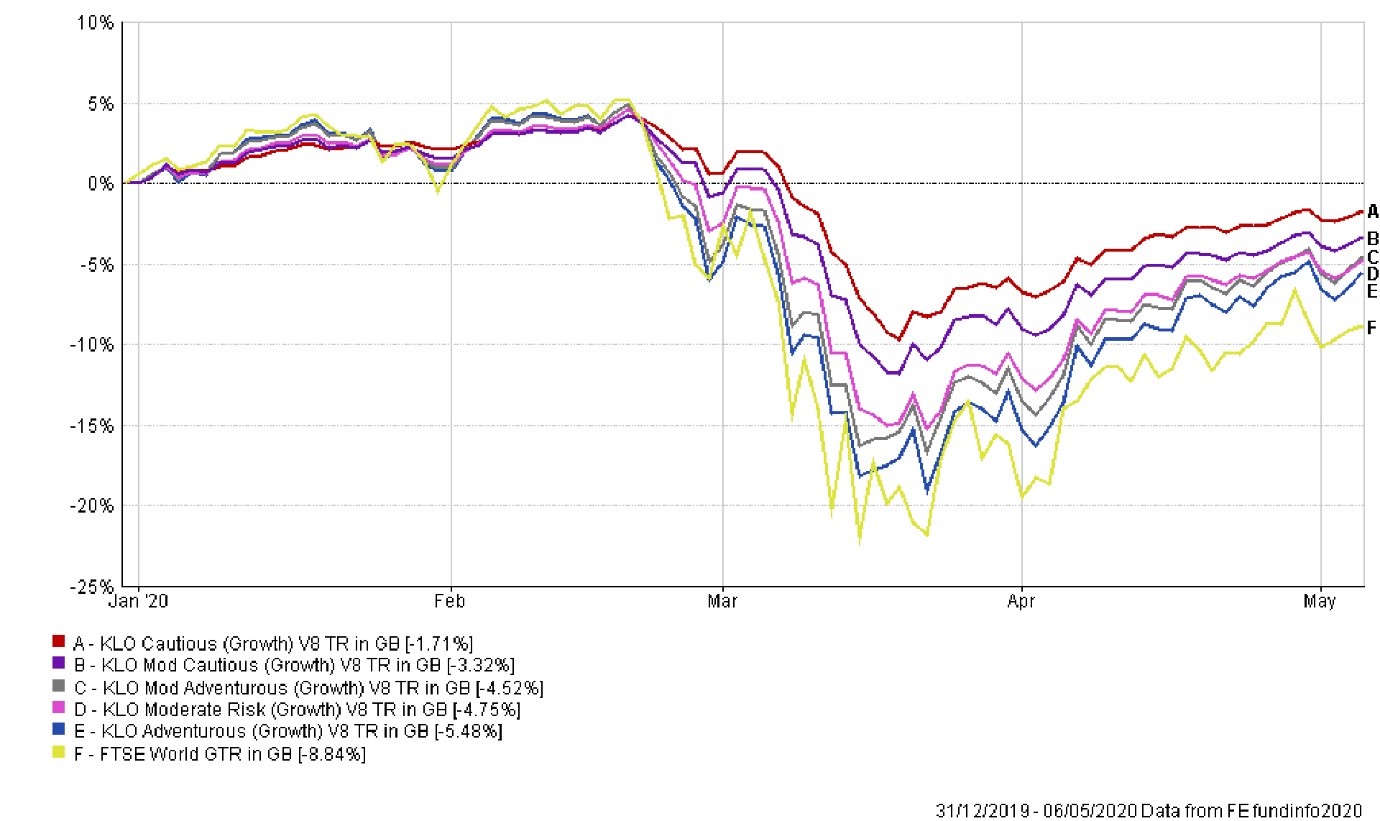

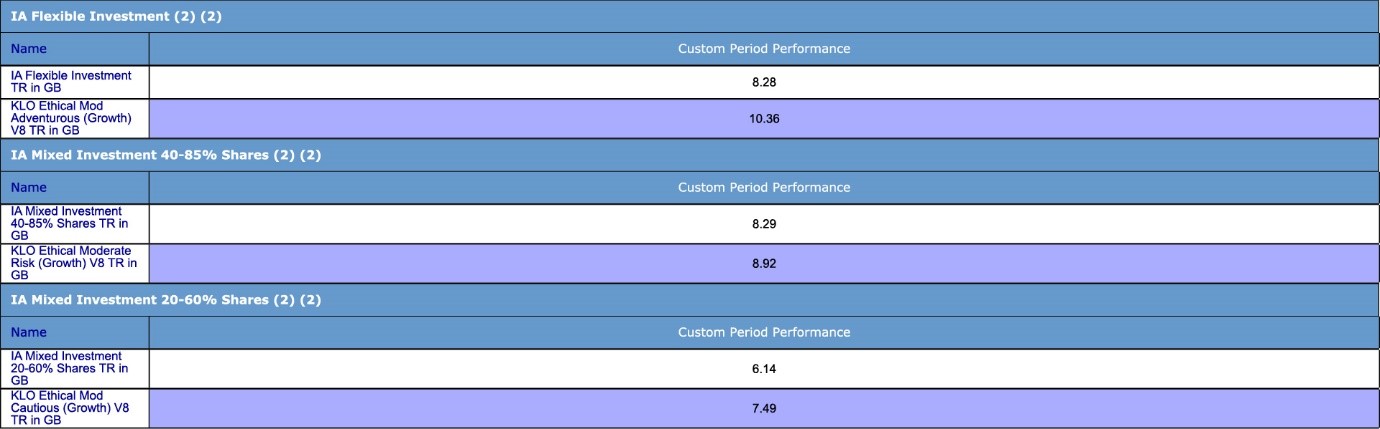

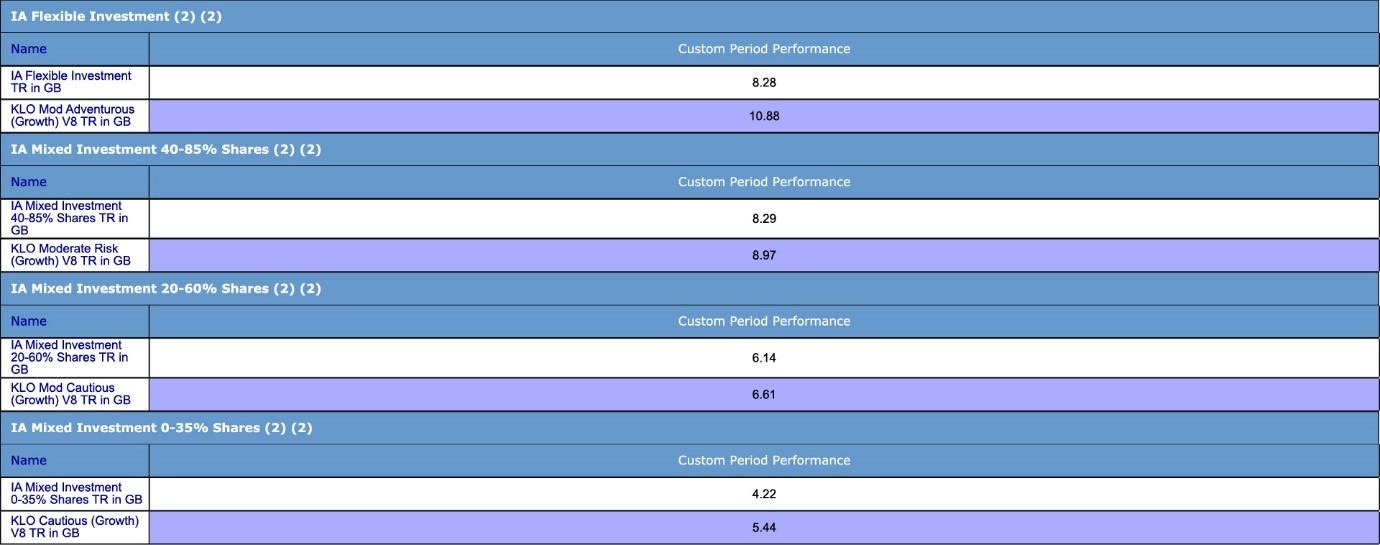

As one can evince from the below graphs, the KLO Growth Model Portfolios V8, including the Ethical ones, managed to withstand the dramatic fall in financial markets, by containing the damage and limiting the losses compared to the general market, as compared for instance to the FTSE World Index:

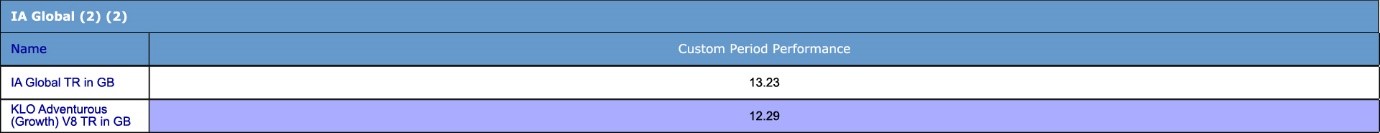

At the same time, the KLO Growth Model Portfolios V8, including the Ethical ones, were able to participate in the strong market rebound that took place in April:

Thanks to its diverse composition, both in terms of asset classes and geographic scope, the KLO Growth Model Portfolios V8 have shown resilience under very stressed market conditions and at the same time had the ability to take advantage of the upside run in strongly performing markets.

When it comes to investing, there are no magic formulas or silver bullets, however diversification and staying invested for the long haul so as to ride out the ups and downs in markets, are the best approaches any investor can rely on in order to try and reap positive investment returns over the long term. We are by no means out of the woods yet, volatility in markets is likely to remain high for the foreseeable future. There are still “known unknowns” such as the expected negative economic numbers that will materialise in the second quarter of 2020, the time it will take to develop a vaccine

or cure to Covid-19 and the possible outbreak of a second wave of the virus this coming winter, that might derail the recovery in financial markets and the economy at large.

However, to quote Churchill at the time of the Battle of Egypt in November 1942, “This is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning”.

¹ Source: FE Analytics, Cumulative Total Return 01.04.2020 – 30.04.2020 in GBP

² Source: FE Analytics, Cumulative Total Return 01.04.2020 – 30.04.2020 in USD

Disclaimer

The value of investments and any income from them may go down as well as up, so you may get back less than you invested. Past performance cannot be relied upon as a guide to future performance. KLO Financial Services Ltd are registered in the UK, company number 08711328. We are authorised and regulated by the Financial Conduct Authority, reference 710272. For any information please visit our website klofinancialservices.com