The UK Election and the Stock Market

The Mini-Budget Still Looms Large…

It is not an exaggeration to state that the upcoming 4 July general election takes place with the ill-fated “mini budget” episode of Autumn 2022 still casting a long shadow.

The strings of unfunded tax cuts featured in the “mini budget” roiled the currency market and the government debt market, with yields on UK government bonds (Gilts) skyrocketing and their price falling sharply, as investors, particularly abroad, started dumping Gilts en masse, fearful for the sustainability of the public finances.

This time around, all the major political parties are aware of the degree to which markets depend on the “kindness of strangers” as the former Bank of England Mark Carney once put it, and the parties’ manifestos strive to present their policy proposals as being fully costed and fiscally responsible.

How Do Election Results Affect Stock Markets?

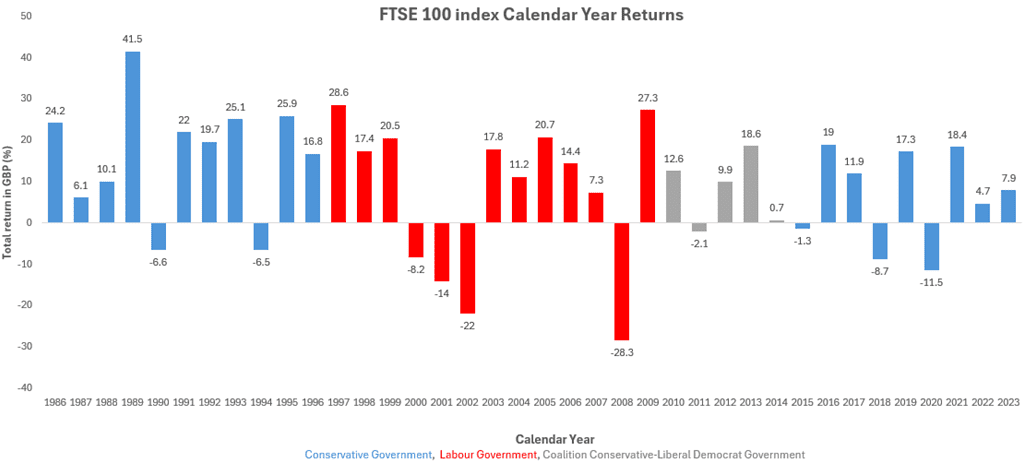

At first glance, by scrutinising the record of the performance of the UK stock market over the last 40 years or so, as proxied by the FTSE 100 index of the largest companies, it appears investors are more optimistic under Conservative governments. The latter have presided over an average stock market return for the FTSE 100 index of almost 12%, whereas the average stock market return has been just over 7% in the years under Labour governments, and around 8% during the years of the Conservatives-Liberal Democrats coalition government.

However, the record under the Labour government is distorted by the external effects of two outsized events, international in nature, namely the bursting of the DotCom tech bubble in the US at the beginning of the new century, and the Global Financial Crisis of 2008-09.

In this respect, it is important to remember that almost 80% of the revenues of the largest companies listed on the FTSE 100 index is generated abroad, hence very much affected by the vagaries of international markets on which the UK national government has extremely limited influence. As an independent financial adviser in London, Birmingham, and Warwick, it is our duty to understand and demonstrate to our clients the potential affects (or lack of) an election, and indeed new government, could have on their investments.

Source: FE Analytics, calendar year total return in GBP

What Can You Expect From This Election?

Generally, opinion polls tend to narrow as the political campaign progresses, however with a current 20 points lead in favour of the Labour party, it is very likely the latter will form the new government after the vote.

The Bank of England is expected to start cutting interest rates this summer, and this should provide a boost to the economy by reducing the cost of borrowing for businesses and households, at the same time probably providing a tailwind for the price of Gilts (yields falling).

A stabilising economy, and barring any unforeseen flare-up in inflation, should also be a positive for the UK stock markets which, from an international perspective, present a buying opportunity by being heavily discounted on a price/earnings basis compared to global markets, such as the US one, for instance.

Hence, no sudden jolt either way is expected in UK financial markets after the election results are in, developments in the international arena such as the pace of global economic growth, the price of oil, or geopolitical events, will likely play a more substantial, but unpredictable, role than the colour of the government in place after the vote.

Benefit From a Personal Financial Adviser

Elections often result in a degree of stock market uncertainty, and the 4 July election may be leaving you wondering what to do with your investments. As an independent financial adviser in Birmingham, Warwick and London, it is our job to help guide your investment strategy and ensure its success, regardless of external factors.

Providing financial services in Birmingham, Warwick, and London, our team will analyse your financial goals, existing investments, and personal beliefs to create a tailored strategy that will meet your needs. This includes finding ethical stocks to invest in and identifying how much you will need to achieve your aims while also living comfortable in retirement.

Get in touch today and speak with an expert financial adviser in Warwick, London, or Birmingham on 01926 492 406 or email enquiries@klofinancialservices.com and a member of our team will get in touch.

Disclaimer

Any research is for information purposes only and does not constitute financial advice. The value of investments and any income from them may go down as well as up, so you may get back less than you invested. Past performance cannot be relied upon as a guide to future performance. KLO Financial Services Ltd are registered in the UK, company number 08711328. We are authorised and regulated by the Financial Conduct Authority, reference 710272. For any information please visit our website www.klofinancialservices.com